Asked by Harish Ravalla on May 25, 2024

Verified

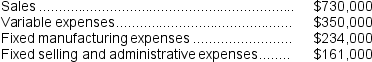

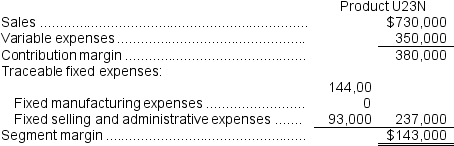

Product U23N has been considered a drag on profits at Jinkerson Corporation for some time and management is considering discontinuing the product altogether.Data from the company's budget for the upcoming year appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

A) $15,000

B) $143,000

C) ($143,000)

D) ($15,000)

Fixed Expenses

Costs that do not change with the level of output or sales and remain constant over a period, such as rent or salaries.

Discontinuing Product

The process of ceasing the manufacture, sale, and support of a product line or brand.

Drag on Profits

Factors or expenses that reduce the overall profitability of a business.

- Ascertain how fixed and variable costs influence the decision to cease production of products.

- Familiarize yourself with the function of avoidable costs in the process of discontinuing a business segment or product.

Verified Answer

JM

Julia MuralovaMay 28, 2024

Final Answer :

C

Explanation :

The fixed expenses that are avoidable if product U23N is discontinued are $144,000 (fixed manufacturing expenses) + $93,000 (fixed selling and administrative expenses) = $237,000.

Therefore, the financial advantage of eliminating this product would be a reduction of $237,000 in fixed expenses for the upcoming year.

Since the question asks for the financial advantage (or disadvantage), the answer should be expressed as a positive or negative figure. In this case, since it is an advantage, the answer should be negative, which is represented by option C) ($143,000).

Therefore, the financial advantage of eliminating this product would be a reduction of $237,000 in fixed expenses for the upcoming year.

Since the question asks for the financial advantage (or disadvantage), the answer should be expressed as a positive or negative figure. In this case, since it is an advantage, the answer should be negative, which is represented by option C) ($143,000).

Explanation :  The segment margin of $143,000 would be lost if product U23N were dropped.

The segment margin of $143,000 would be lost if product U23N were dropped.

The segment margin of $143,000 would be lost if product U23N were dropped.

The segment margin of $143,000 would be lost if product U23N were dropped.

Learning Objectives

- Ascertain how fixed and variable costs influence the decision to cease production of products.

- Familiarize yourself with the function of avoidable costs in the process of discontinuing a business segment or product.