Asked by natasha savage on Jul 08, 2024

Verified

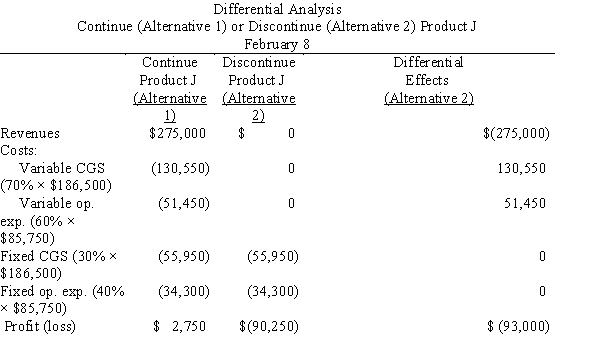

Product J is one of the many products manufactured and sold by Oceanside Company. An income statement by product line for the past year indicated a net profit for Product J of $2,750. This net profit resulted from sales of $275,000, cost of goods sold of $186,500, and operating expenses of $85,750. It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 40% of the operating expense is fixed. If Product J is retained, the revenue, costs, and expenses are not expected to change significantly from those of the current year. Because of the large number of products manufactured, the total fixed costs and expenses are not expected to decline significantly if Product J is discontinued.

Should the company continue or discontinue producing Product J? Prepare a differential analysis report to support your answer.

Differential Analysis

A decision-making tool that examines the financial impact of alternative business decisions by focusing only on the relevant costs and benefits that differ between choices.

Fixed Factory Overhead

The consistent, non-variable expenses incurred by a manufacturing plant, which are required to maintain the production process but do not fluctuate with the level of output.

Operating Expense

Costs associated with the day-to-day running of a business, such as rent, utilities, and salaries, but excluding the cost of goods sold.

- Acquire proficiency in differential analysis and its application in decision contexts.

Verified Answer

Learning Objectives

- Acquire proficiency in differential analysis and its application in decision contexts.

Related questions

Gull Corp Is Considering Selling Its Old Popcorn Machine and ...

Oficina Bonita Company Manufactures Office Furniture ...

Evaluation of How Profit Will Change Based on an Alternative ...

Evaluation of How Income Will Change Based on an Alternative ...

Hadley Company Is Considering the Disposal of Equipment That Is ...