Asked by Emily Keith on Jun 27, 2024

Verified

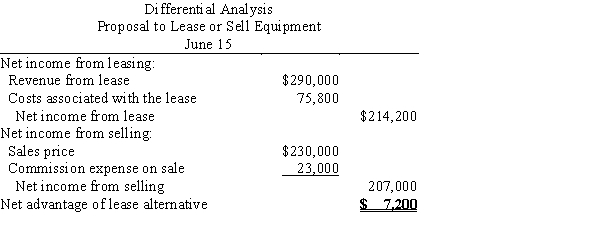

Hadley Company is considering the disposal of equipment that is no longer needed for operations. The equipment originally cost $600,000 and accumulated depreciation to date totals $460,000. An offer has been received to lease the machine for its remaining useful life for a total of $290,000, after which the equipment will have no salvage value. The repair, insurance, and property tax expenses that would be incurred by Hadley on the machine during the period of the lease are estimated at $75,800. Alternatively, the equipment can be sold through a broker for $230,000 less a 10% commission.Prepare a differential analysis report, dated June 15, on whether the equipment should be leased or sold.

Differential Analysis

A decision-making technique that involves comparing the costs and benefits of alternative actions.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset up to a specific date, reflecting its wear and use over time.

Salvage Value

The estimated residual value of an asset at the end of its useful life, often considered in depreciation calculations.

- Conduct differential analysis to aid decision-making in various business settings.

Verified Answer

Learning Objectives

- Conduct differential analysis to aid decision-making in various business settings.

Related questions

Evaluation of How Income Will Change Based on an Alternative ...

Evaluation of How Profit Will Change Based on an Alternative ...

Product J Is One of the Many Products Manufactured and ...

Gull Corp Is Considering Selling Its Old Popcorn Machine and ...

Oficina Bonita Company Manufactures Office Furniture ...