Asked by Gloria Kirby on Jun 14, 2024

Verified

Prepare the required entries for the following transactions:

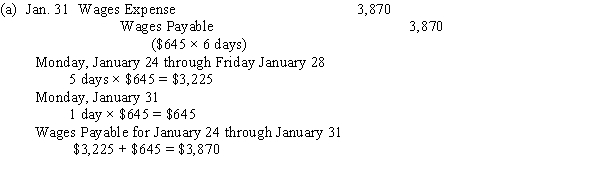

(a)Austin Company pays daily wages of $645

(Monday-Friday). Paydays are every other Friday. Prepare the Monday, January 31 adjusting entry, assuming that the previous payday was Friday, January 21.

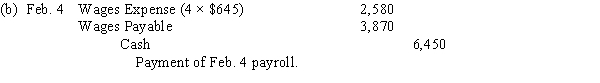

(b)Prepare the journal entry to record Austin Company's payroll on Friday, February 4.

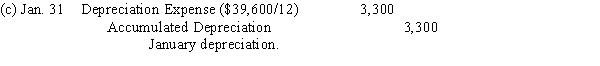

(c)Annual depreciation expense on the company's fixed assets is $39,600. Prepare the adjusting entry to recognize depreciation for the month of January.

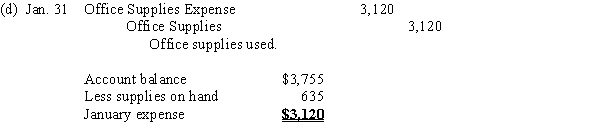

(d)The company's office supplies account shows a debit balance of $3,755. A count of office supplies on hand on January 31 shows $635 worth of supplies on hand. Prepare the January 31 adjusting entry for Office Supplies.

Adjusting Entries

Journal entries made in accounting to update the records for expenses and revenues that have accrued but are not yet recorded.

Daily Wages

The amount of money that a worker earns for one day of labor.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the consumption of the asset.

- Catalog adjusting entries in the journal for unearned revenues, prepaid expenses, accrued expenses, and depreciation.

- Construct essential payroll adjustments within journal entries.

- Calculate and adjust for supplies and insurance expense adjustments.

Verified Answer

ST

Learning Objectives

- Catalog adjusting entries in the journal for unearned revenues, prepaid expenses, accrued expenses, and depreciation.

- Construct essential payroll adjustments within journal entries.

- Calculate and adjust for supplies and insurance expense adjustments.

Related questions

On December 31, a Business Estimates Depreciation on Equipment Used ...

Jordon James Started JJJ Consulting on January 1 ...

The Supplies Account Balance on December 31, $4,750; Supplies on ...

On January 2, Safe Motorcycling Monthly Received a Check for ...

Listed Below Are Accounts to Use for Transactions ...