Asked by Jessa Gesta on Apr 27, 2024

Verified

Prepare the required entries for the following transactions:

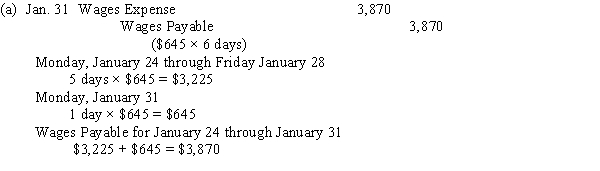

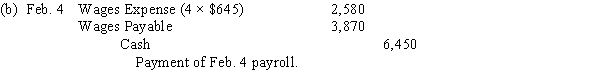

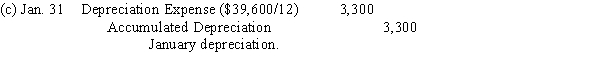

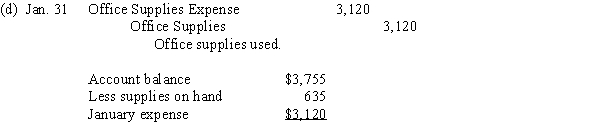

(a)Austin Company pays daily wages of $645 (Monday - Friday). Paydays are every other Friday. Prepare the Monday, January 31 adjusting entry, assuming that the previous payday was Friday, January 21.(b)Prepare the journal entry to record the Austin Company's payroll on Friday, February 4.(c)Annual depreciation expense on the company's fixed assets is $39,600. Prepare the adjusting entry to recognize depreciation for the month of January.(d)The company's office supplies account shows a debit balance of $3,755. A count of office supplies on hand on January 31 shows $635 worth of supplies on hand. Prepare the January 31 adjusting entry for Office Supplies.

Daily Wages

Compensation based on the number of days worked, typically paid to temporary or contract workers.

Depreciation Expense

The allocated reduction in the cost of tangible fixed assets over their useful life for accounting and tax purposes.

Office Supplies

Items and materials used in an office for writing, printing, filing, and general functionality, including paper, pens, and office equipment.

- Master the rationale and procedures for the recording of adjusting entries in the accounting period.

- Discover and generate journal entries for a range of adjusting entries, including prepayments, accruals, and depreciation.

- Execute calculations and documentation of journal entries pertaining to payroll and its related adjustments.

Verified Answer

Learning Objectives

- Master the rationale and procedures for the recording of adjusting entries in the accounting period.

- Discover and generate journal entries for a range of adjusting entries, including prepayments, accruals, and depreciation.

- Execute calculations and documentation of journal entries pertaining to payroll and its related adjustments.

Related questions

On November 15, Great Designs Company Purchased an Advertising Campaign ...

Accrued Salaries of $600 Owed to Employees for December 29 ...

On November 1, Clients of Great Designs Company Prepaid $4,250 ...

On January 1, Great Designs Company Had a Debit Balance ...

For the Year Ending June 30, Island Clinical Services Mistakenly ...