Asked by Haseeb Akhtar on Apr 27, 2024

Verified

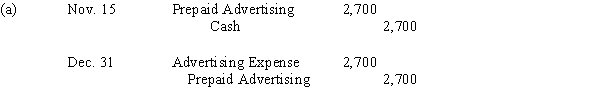

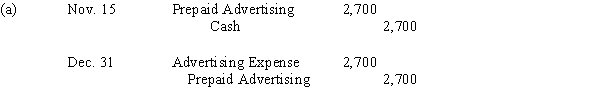

On November 15, Great Designs Company purchased an advertising campaign for the month of December. Great Designs paid cash of $2,700 in advance. The advertising campaign ran in December and was completed on December 31.

(a) Prepare all necessary journal entries for the advertising campaign for November and December .(b) Explain why you prepared this/these journal entries.

Journal Entries

Recorded transactions in the accounting records of a business that are used to transfer amounts from one account to another.

Advertising Campaign

A series of advertisement messages that share a single idea and theme which make up an integrated marketing communication.

Cash

A form of current asset representing currency or currency equivalents that can be accessed immediately or near-immediately.

- Understand the purpose and process of recording adjusting entries in the accounting cycle.

- Identify and prepare journal entries for various types of adjusting entries including prepayments, accruals, and depreciation.

Verified Answer

HB

Heather BarthApr 30, 2024

Final Answer :  (b)Under the matching concept, the expense should be recorded in the month of December when the advertising campaign ran, even though the cash was paid in November. Thus, the November journal entry creates an asset, prepaid advertising. The December 31 entry recognizes the advertising expense in December and eliminates the prepaid asset.

(b)Under the matching concept, the expense should be recorded in the month of December when the advertising campaign ran, even though the cash was paid in November. Thus, the November journal entry creates an asset, prepaid advertising. The December 31 entry recognizes the advertising expense in December and eliminates the prepaid asset.

(b)Under the matching concept, the expense should be recorded in the month of December when the advertising campaign ran, even though the cash was paid in November. Thus, the November journal entry creates an asset, prepaid advertising. The December 31 entry recognizes the advertising expense in December and eliminates the prepaid asset.

(b)Under the matching concept, the expense should be recorded in the month of December when the advertising campaign ran, even though the cash was paid in November. Thus, the November journal entry creates an asset, prepaid advertising. The December 31 entry recognizes the advertising expense in December and eliminates the prepaid asset.

Learning Objectives

- Understand the purpose and process of recording adjusting entries in the accounting cycle.

- Identify and prepare journal entries for various types of adjusting entries including prepayments, accruals, and depreciation.