Asked by Andrew Shoffler on May 11, 2024

Verified

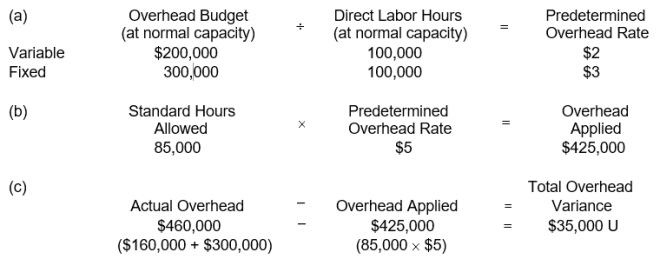

Platt Company produces one product a putter called PAR-putter. Platt uses a standard cost system and determines that it should take one hour of direct labor to produce one PAR-putter. The normal production capacity for this putter is 100000 units per year. The total budgeted overhead at normal capacity is $500000 comprised of $200000 of variable costs and $300000 of fixed costs. Platt applies overhead on the basis of direct labor hours.

During the current year Platt produced 85000 putters worked 89000 direct labor hours and incurred variable overhead costs of $160000 and fixed overhead costs of $300000.

Instructions

(a) Compute the predetermined variable overhead rate and the predetermined fixed overhead rate.

(b) Compute the applied overhead for Platt for the year.

(c) Compute the total overhead variance.

Variable Overhead Rate

A metric that represents the variable costs incurred to operate a business, changing with the level of production or activity.

Fixed Overhead Rate

A set rate used to allocate fixed indirect costs of production to individual units or activity bases.

Total Overhead Variance

The difference between the actual overhead costs incurred and the standard overhead costs allocated for a particular period, used for budgeting and cost control purposes.

- Acquire knowledge on how to compute variances within manufacturing overhead that include aspects such as controllable and volume variances.

- Calculate and understand overhead application rates and their impact on overhead variances.

Verified Answer

MW

Learning Objectives

- Acquire knowledge on how to compute variances within manufacturing overhead that include aspects such as controllable and volume variances.

- Calculate and understand overhead application rates and their impact on overhead variances.