Asked by Cylas Kawika on May 19, 2024

Verified

Planner Corporation's comparative balance sheets are presented below. PLANNER CORPORATION Comparative Balance Sheets December 3120172016 Cash $21,570$10,700 Accounts receivable 18,20023,400 Land 18,00026,000 Building 70,00070,000 Accumulated depreciation (15,000)‾(10,000)‾ Total $112,770‾$120,100‾ Accounts payable $12,370$31,100 Common stock 75,00069,000 Retained earnings 25,400‾20,000‾ Total $112,770‾‾120,100‾‾\begin{array}{c}\text { PLANNER CORPORATION }\\\text { Comparative Balance Sheets }\\\text { December 31}\\\begin{array}{lrr}&2017&2016\\\text { Cash } & \$ 21,570 & \$ 10,700 \\\text { Accounts receivable } & 18,200 & 23,400 \\\text { Land } & 18,000 & 26,000 \\\text { Building } & 70,000 & 70,000 \\\text { Accumulated depreciation } & \underline{(15,000)} & \underline{(10,000)} \\\quad \text { Total } & \underline{\$ 112,770} & \underline{\$ 120,100} \\\\\text { Accounts payable } & \$ 12,370 & \$ 31,100 \\\text { Common stock } & 75,000 & 69,000 \\\text { Retained earnings } & \underline{25,400} & \underline{20,000} \\\quad \text { Total } & \underline{\underline{\$ 112,770}} & \underline{\underline{120, 100}}\end{array}\end{array} PLANNER CORPORATION Comparative Balance Sheets December 31 Cash Accounts receivable Land Building Accumulated depreciation Total Accounts payable Common stock Retained earnings Total 2017$21,57018,20018,00070,000(15,000)$112,770$12,37075,00025,400$112,7702016$10,70023,40026,00070,000(10,000)$120,100$31,10069,00020,000120,100 Additional information:

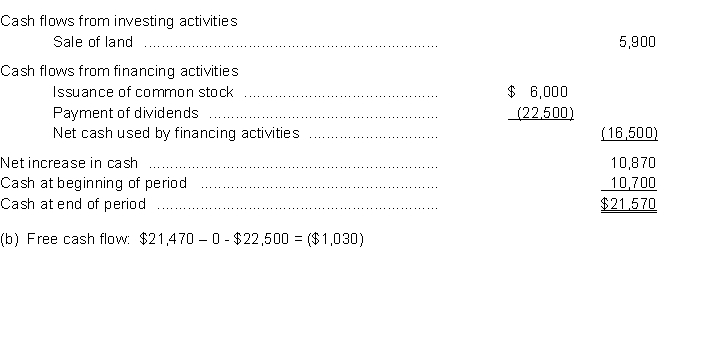

1. Net income was $27900. Dividends declared and paid were $22500.

2. All other changes in noncurrent account balances had a direct effect on cash flows except the change in accumulated depreciation. The land was sold for $5900.

Instruction

(a) Prepare a statement of cash flows for 2017 using the indirect method.

(b) Compute free cash flow.

Indirect Method

A way of reporting cash flows from operating activities on the cash flow statement, where net income is adjusted for changes in balance sheet accounts to reconcile to cash provided by or used in operations.

Comparative Balance Sheets

Financial statements that present the assets, liabilities, and equity of an entity at different points in time for comparison.

Free Cash Flow

The cash a company generates after accounting for cash outflows to support operations and maintain capital assets.

- Learn the techniques for drafting the statement of cash flows via direct and indirect strategies.

- Clarify the relevance and methodology of calculating free cash flow.

Verified Answer

Learning Objectives

- Learn the techniques for drafting the statement of cash flows via direct and indirect strategies.

- Clarify the relevance and methodology of calculating free cash flow.

Related questions

Cash Flows from Operating Activities Can Be Calculated Using the ...

The Operating Activities Section of the Statement of Cash Flows ...

State the Section (S) of the Statement of Cash Flows ...

On the Basis of the Following Data for Branch Co ...

The Comparative Balance Sheets of Barry Company, for Years 1 ...