Asked by Jessica Pierre on Apr 28, 2024

Verified

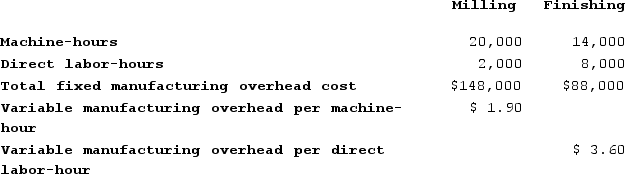

Petty Corporation has two production departments, Milling and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The estimated total manufacturing overhead for the Milling Department is closest to:

The estimated total manufacturing overhead for the Milling Department is closest to:

A) $408,000

B) $38,000

C) $148,000

D) $186,000

Milling Department

The milling department refers to a specific section within a manufacturing facility where milling, a process of using rotary cutters to remove material, is performed.

Manufacturing Overhead

All indirect costs associated with the manufacturing process, including those related to running the factory outside direct labor and materials.

Job-Order Costing System

A cost accounting system in which costs are assigned to specific jobs or orders, used in industries where goods or services are produced to order.

- Estimate the comprehensive expected manufacturing overhead for the production sectors.

Verified Answer

Learning Objectives

- Estimate the comprehensive expected manufacturing overhead for the production sectors.

Related questions

Garza Corporation Has Two Production Departments, Casting and Customizing ...

Marciante Corporation Has Two Production Departments, Casting and Finishing ...

The Estimated Total Manufacturing Overhead for the Assembly Department Is ...

Dallman Corporation Uses a Job-Order Costing System with a Single ...

The Estimated Total Manufacturing Overhead Is Closest To