Asked by Deneatra Caesar on May 04, 2024

Verified

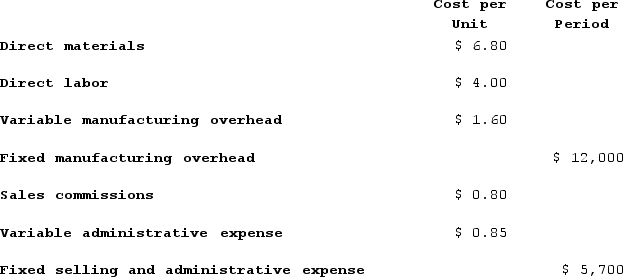

Pedregon Corporation has provided the following information:  If 3,000 units are sold, the total variable cost is closest to:

If 3,000 units are sold, the total variable cost is closest to:

A) $46,800

B) $55,500

C) $42,150

D) $37,200

Total Variable Cost

The total of all expenses that change in direct proportion to the amount of goods or services produced.

- Outline the dissimilarities between fixed and variable financial charges.

- Measure both collective and singular costs within the suitable range.

Verified Answer

JM

Jasmine MaquirangMay 06, 2024

Final Answer :

C

Explanation :

The given information does not provide a breakdown of fixed and variable costs, so we need to use the contribution margin approach to solve the problem.

Contribution margin per unit = selling price per unit - variable cost per unit

= $23 - $10

= $13

Total contribution margin = contribution margin per unit x number of units sold

= $13 x 3,000

= $39,000

Total variable cost = total contribution margin - total fixed cost

We do not know the total fixed cost, but we can use the information given to find the break-even point:

Break-even point (in units) = total fixed cost / contribution margin per unit

= 22,000 / 13

≈ 1,692.31

Since the break-even point is between 1,500 and 2,000 units, we can assume that the fixed cost is about $22,000.

Total variable cost = $39,000 - $22,000

= $17,000

However, the question asks for the total variable cost when 3,000 units are sold. We can use the high-low method to estimate the variable cost per unit:

Highest activity level:

Units sold = 4,000

Total cost = $52,800

Fixed cost = $22,000

Variable cost = total cost - fixed cost

= $52,800 - $22,000

= $30,800

Variable cost per unit = variable cost / units sold

= $30,800 / 4,000

= $7.70

Lowest activity level:

Units sold = 2,000

Total cost = $32,800

Fixed cost = $22,000

Variable cost = total cost - fixed cost

= $32,800 - $22,000

= $10,800

Variable cost per unit = variable cost / units sold

= $10,800 / 2,000

= $5.40

Using the highest and lowest activity levels, we can estimate the variable cost at the 3,000-unit level:

Variable cost at high level + [(Variable cost per unit) x (Actual activity level - High level)]

= $30,800 + ($7.70 x (3,000 - 4,000))

= $30,800 - $7,700

= $23,100

Therefore, the closest estimate of the total variable cost at the 3,000-unit level is $23,100, which is closest to choice C ($42,150 is the closest answer choice to $23,100).

Contribution margin per unit = selling price per unit - variable cost per unit

= $23 - $10

= $13

Total contribution margin = contribution margin per unit x number of units sold

= $13 x 3,000

= $39,000

Total variable cost = total contribution margin - total fixed cost

We do not know the total fixed cost, but we can use the information given to find the break-even point:

Break-even point (in units) = total fixed cost / contribution margin per unit

= 22,000 / 13

≈ 1,692.31

Since the break-even point is between 1,500 and 2,000 units, we can assume that the fixed cost is about $22,000.

Total variable cost = $39,000 - $22,000

= $17,000

However, the question asks for the total variable cost when 3,000 units are sold. We can use the high-low method to estimate the variable cost per unit:

Highest activity level:

Units sold = 4,000

Total cost = $52,800

Fixed cost = $22,000

Variable cost = total cost - fixed cost

= $52,800 - $22,000

= $30,800

Variable cost per unit = variable cost / units sold

= $30,800 / 4,000

= $7.70

Lowest activity level:

Units sold = 2,000

Total cost = $32,800

Fixed cost = $22,000

Variable cost = total cost - fixed cost

= $32,800 - $22,000

= $10,800

Variable cost per unit = variable cost / units sold

= $10,800 / 2,000

= $5.40

Using the highest and lowest activity levels, we can estimate the variable cost at the 3,000-unit level:

Variable cost at high level + [(Variable cost per unit) x (Actual activity level - High level)]

= $30,800 + ($7.70 x (3,000 - 4,000))

= $30,800 - $7,700

= $23,100

Therefore, the closest estimate of the total variable cost at the 3,000-unit level is $23,100, which is closest to choice C ($42,150 is the closest answer choice to $23,100).

Learning Objectives

- Outline the dissimilarities between fixed and variable financial charges.

- Measure both collective and singular costs within the suitable range.