Asked by Abigail Aleman on May 28, 2024

Verified

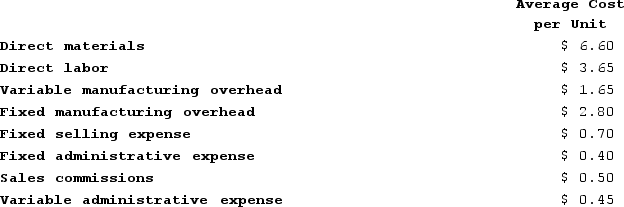

Barredo Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,000 units, its average costs per unit are as follows:  If 4,000 units are sold, the variable cost per unit sold is closest to:

If 4,000 units are sold, the variable cost per unit sold is closest to:

A) $16.75

B) $12.85

C) $11.90

D) $14.70

Variable Cost

Costs that vary directly with the level of production or service provision, such as materials, labor, and utilities consumed in the production process.

- Differentiate static and dynamic cost structures.

- Identify the total and unitary costs within the relevant spectrum.

Verified Answer

MS

Mirela SaletovicMay 30, 2024

Final Answer :

B

Explanation :

In the given information, the relevant range of activity is 3,000 to 7,000 units and the average costs per unit at 5,000 units are provided. Therefore, we can calculate the total cost and the variable cost per unit based on this information.

At 5,000 units, the total cost = $79,000 and the variable cost per unit = ($52,000 - $12,000) / 5,000 units = $8 per unit.

To find the variable cost per unit at 4,000 units sold, we need to consider the behavior of variable costs. If we assume that the variable cost per unit remains constant within the relevant range, we can use the cost formula to calculate the variable cost per unit.

Using the cost formula, we have:

Total cost = Fixed cost + Variable cost per unit x Number of units

At 5,000 units, Total cost = $79,000

At 4,000 units, Total cost = Fixed cost + Variable cost per unit x 4,000 units

We can solve for the variable cost per unit as follows:

Variable cost per unit = (Total cost - Fixed cost) / Number of units

Variable cost per unit = ($79,000 - Fixed cost) / 5,000 units

To find the fixed cost, we can use the high-low method. Based on the given information, the variable cost per unit at 5,000 units is $8 per unit. If we use the information at 3,000 units and assume that the fixed cost is $1,000, we can calculate the variable cost per unit as follows:

Total cost at 3,000 units = $37,000

Variable cost at 3,000 units = Total cost - Fixed cost = $37,000 - $1,000 = $36,000

Variable cost per unit at 3,000 units = Variable cost / Number of units = $36,000 / 3,000 units = $12 per unit

Using this information, we can calculate the fixed cost as follows:

Total cost = Fixed cost + Variable cost per unit x Number of units

$79,000 = Fixed cost + $8 per unit x 5,000 units

Fixed cost = $39,000

Now we can calculate the variable cost per unit at 4,000 units as follows:

Variable cost per unit = ($79,000 - $39,000) / 5,000 units

Variable cost per unit = $40,000 / 5,000 units

Variable cost per unit = $8 per unit

Therefore, the variable cost per unit at 4,000 units sold is closest to $12.85, which is option B.

At 5,000 units, the total cost = $79,000 and the variable cost per unit = ($52,000 - $12,000) / 5,000 units = $8 per unit.

To find the variable cost per unit at 4,000 units sold, we need to consider the behavior of variable costs. If we assume that the variable cost per unit remains constant within the relevant range, we can use the cost formula to calculate the variable cost per unit.

Using the cost formula, we have:

Total cost = Fixed cost + Variable cost per unit x Number of units

At 5,000 units, Total cost = $79,000

At 4,000 units, Total cost = Fixed cost + Variable cost per unit x 4,000 units

We can solve for the variable cost per unit as follows:

Variable cost per unit = (Total cost - Fixed cost) / Number of units

Variable cost per unit = ($79,000 - Fixed cost) / 5,000 units

To find the fixed cost, we can use the high-low method. Based on the given information, the variable cost per unit at 5,000 units is $8 per unit. If we use the information at 3,000 units and assume that the fixed cost is $1,000, we can calculate the variable cost per unit as follows:

Total cost at 3,000 units = $37,000

Variable cost at 3,000 units = Total cost - Fixed cost = $37,000 - $1,000 = $36,000

Variable cost per unit at 3,000 units = Variable cost / Number of units = $36,000 / 3,000 units = $12 per unit

Using this information, we can calculate the fixed cost as follows:

Total cost = Fixed cost + Variable cost per unit x Number of units

$79,000 = Fixed cost + $8 per unit x 5,000 units

Fixed cost = $39,000

Now we can calculate the variable cost per unit at 4,000 units as follows:

Variable cost per unit = ($79,000 - $39,000) / 5,000 units

Variable cost per unit = $40,000 / 5,000 units

Variable cost per unit = $8 per unit

Therefore, the variable cost per unit at 4,000 units sold is closest to $12.85, which is option B.

Learning Objectives

- Differentiate static and dynamic cost structures.

- Identify the total and unitary costs within the relevant spectrum.