Asked by Aubrey Hadley on Jul 08, 2024

Verified

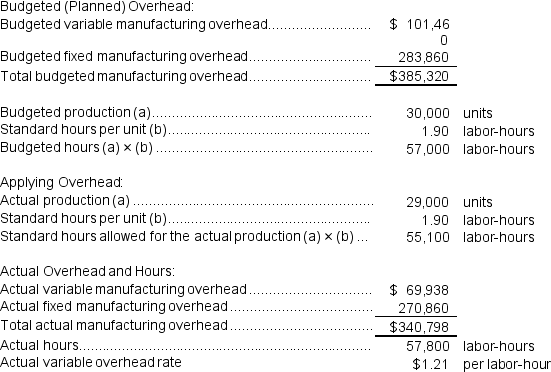

Pearlman Incorporated makes a single product--an electrical motor used in many long-haul trucks.The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period.Data concerning the most recent year appear below:  Required:

Required:

a.Determine the variable overhead rate variance for the year.

b.Determine the variable overhead efficiency variance for the year.

c.Determine the fixed overhead budget variance for the year.

d.Determine the fixed overhead volume variance for the year.

Variable Overhead Efficiency

Variable overhead efficiency refers to the effectiveness with which a company manages its variable manufacturing overhead costs in relation to its production activities.

Rate Variance

The difference between the expected or standard cost and the actual cost incurred for a particular expense, often analyzed in budgeting and cost management.

Budget Variance

The difference between the budgeted or planned amount of expense or revenue and the actual amount incurred or received.

- Evaluate the variable overhead rate variance and efficiency-related variances.

- Analyze the deviations in fixed overhead costs from the budgeted amounts and actual volumes.

Verified Answer

= $1.78 per labor-hour

Variable overhead rate variance = (AH × AR)- (AH × SR)

= ($69,938)- (57,800 labor-hours × $1.78 per labor-hour)

= ($69,938)- ($102,884)

= $32,946 F

or

Variable overhead rate variance = AH × (AR - SR)

= 57,800 labor-hours × ($1.21 per labor-hour - $1.78 per labor-hour)

= 57,800 labor-hours × (-$0.57 per labor-hour)

= $32,946 F

b.Labor efficiency variance = (AH - SH)× SR

= (57,800 labor-hours - 55,100 labor-hours)× $1.78 per labor-hour

= (2,700 labor-hours)× $1.78 per labor-hour

= $4,806 U

c.Budget variance = Actual fixed overhead - Budgeted fixed overhead

= $270,860 - $283,860 = $13,000 F

d.Fixed component of the predetermined overhead rate = $283,860/57,000 labor-hours

= $4.98 per labor-hour

Volume variance = Budgeted fixed overhead - Fixed overhead applied to work in process

= $283,860 - ($4.98 per labor-hour × 55,100 labor-hours)

= $283,860 - ($274,398)

= $9,462 U

or

Volume variance = Fixed component of the predetermined overhead rate x (Denominator hours - Standard hours allowed for the actual output)

= $4.98 per labor-hour x (57,000 labor-hours - 55,100 labor-hours)

= $4.98 per labor-hour x (57,000 labor-hours - 55,100 labor-hours)

= $4.98 per labor-hour x (1,900 hours)

= $9,462 U

Learning Objectives

- Evaluate the variable overhead rate variance and efficiency-related variances.

- Analyze the deviations in fixed overhead costs from the budgeted amounts and actual volumes.

Related questions

Edlow Incorporated Makes a Single Product--A Critical Part Used in ...

Berk Incorporated Makes a Single Product--A Critical Part Used in ...

Moozi Dairy Products Processes and Sells Two Products: Milk and ...

The Variable Overhead Efficiency Variance for the Month Is Closest ...

The Variable Overhead Efficiency Variance for the Month Is Closest ...