Asked by Carmen LeMaster on Jul 22, 2024

Verified

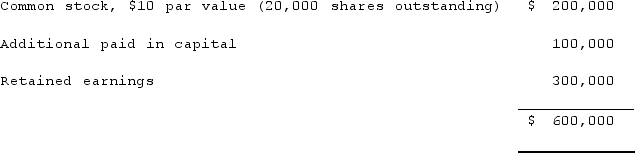

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:  Glotfelty issues 5,000 shares of previously unissued stock to the public for $22 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

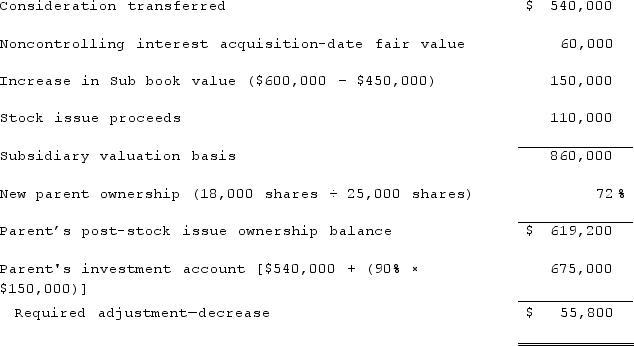

Glotfelty issues 5,000 shares of previously unissued stock to the public for $22 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Stockholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing the owners' claim on the company.

Unissued Stock

Shares that have been authorized by a company's charter but have not been issued or sold to investors.

Shares

Units of ownership interest in a corporation or financial asset, representing an equal proportion of the company's capital.

- Assess how stock dealings influence a parent company's investment in its subsidiary.

Verified Answer

SB

Shelbe ButnerJul 26, 2024

Final Answer :

The investment account and APIC would be decreased by $55,800, as shown below:

Learning Objectives

- Assess how stock dealings influence a parent company's investment in its subsidiary.