Asked by Big Citric's World on May 22, 2024

Verified

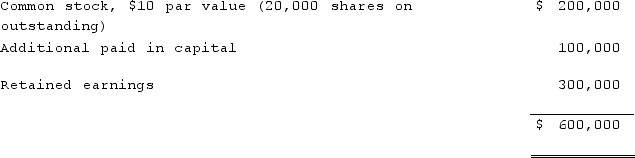

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:  Glotfelty issues 5,000 shares of previously unissued stock to Panton for $35 per share.Required:Describe how this transaction would affect Panton's books.

Glotfelty issues 5,000 shares of previously unissued stock to Panton for $35 per share.Required:Describe how this transaction would affect Panton's books.

Book Value

The net value of a company's assets minus its liabilities, essentially representing the total value if it were liquidated according to the balance sheet.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting liabilities, represented by the equity stockholders have from share investments and retained earnings.

Stock Traded

Shares of a company that are bought and sold on a stock exchange platform.

- Analyze the impact of stock transactions on the parent company’s investment in a subsidiary.

Verified Answer

AC

Amanduh CascarelliMay 25, 2024

Final Answer :

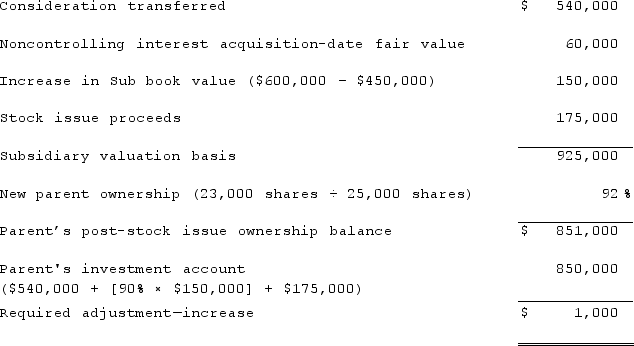

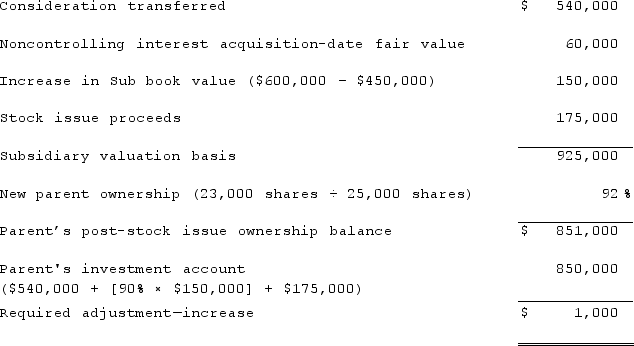

The investment account and APIC will be increased by $1,000, as shown below:

Learning Objectives

- Analyze the impact of stock transactions on the parent company’s investment in a subsidiary.