Asked by Grace Ferreira on May 27, 2024

Verified

On March 31,2019,Kudos Corporation paid $20,000,000 for 2,000,000,$1 par value,shares of the voting stock of Nutribar Corporation.This investment represented 40% of Nutribar's outstanding shares.On December 12,2019,Nutribar declared and paid a $1,000,000 cash dividend and reported net income for the year ended 2019 of $10,000,000.On December 31,2019,Nutribar's stock was trading at $11.50 per share.

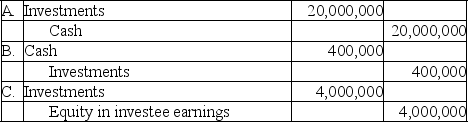

A.Record the journal entry on Kudos' book for the acquisition of Nutribar on March 31,2019.

B.Record the cash dividend received by Kudos on December 12,2019.

C.Record any end of year entries needed on Kudos' books.

Voting Stock

Shares that grant the holder the right to vote on company matters, typically influencing board elections and corporate policy.

Cash Dividend

A payment made by a company out of its earnings to its shareholders, usually in the form of cash.

Net Income

The income a company retains following the deduction of all costs and taxes from its total earnings.

- Utilize the equity approach when accounting for enduring investments.

- Examine and document dealings regarding the acquisition of another firm's ordinary shares.

Verified Answer

Learning Objectives

- Utilize the equity approach when accounting for enduring investments.

- Examine and document dealings regarding the acquisition of another firm's ordinary shares.

Related questions

ADiscuss the Criteria for Applying the Equity Method of Accounting ...

Donald Corporation Purchased 3,000 Shares of the Outstanding Common Voting ...

Discuss How the Equity Method of Accounting for Investments Prevents ...

On December 31,2019,Jean World Corporation Recorded the Following Journal Entry ...

Steven Company Owns 40% of the Outstanding Voting Common Stock ...