Asked by Lauren Lawlor on May 26, 2024

Verified

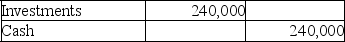

Donald Corporation purchased 3,000 shares of the outstanding common voting stock of Apprentice Corporation on January 2,2019,for $80 per share.At the date of purchase Apprentice Corporation had outstanding 10,000 shares of common stock with a par value of $50 per share.During 2019,Apprentice reported net income of $60,000 and declared and paid a $5,000 cash dividend.The December 31,2019,fair value of Apprentice's stock was $84.

Prepare the journal entries required for Donald Corporation on January 2,2019 and December 31,2019.

Voting Stock

Shares that give the shareholder the right to vote on corporate matters, typically regarding the election of the board of directors.

Net Income

Net income is the total profit of a company after all expenses, taxes, and costs have been deducted from total revenues.

Cash Dividend

A distribution of a company's profits paid to shareholders in the form of cash.

- Adopt the equity method in documenting financial transactions for extended investments.

- Investigate and log activities related to buying shares of common stock from a different corporation.

Verified Answer

Learning Objectives

- Adopt the equity method in documenting financial transactions for extended investments.

- Investigate and log activities related to buying shares of common stock from a different corporation.

Related questions

ADiscuss the Criteria for Applying the Equity Method of Accounting ...

On March 31,2019,Kudos Corporation Paid $20,000,000 for 2,000,000,$1 Par Value,shares ...

Discuss How the Equity Method of Accounting for Investments Prevents ...

On December 31,2019,Jean World Corporation Recorded the Following Journal Entry ...

Steven Company Owns 40% of the Outstanding Voting Common Stock ...

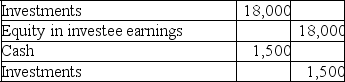

December 31,2019:

December 31,2019: