Asked by robin singh on Apr 27, 2024

Verified

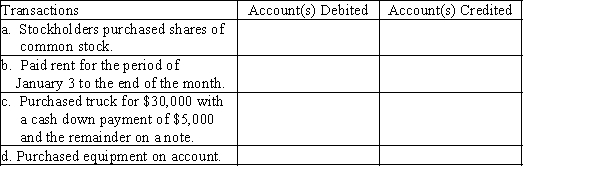

On January 1, Merry Walker and other stockholders established a catering service. Listed below are accounts to use for transactions (a) through (d), each identified by a number. Following this list are the transactions that occurred during the first month of operations. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number(s) in the appropriate box.

1.Cash

2.Accounts Receivable

3.Supplies

4.Prepaid Insurance

5.Equipment

6.Truck

7.Notes Payable

8.Accounts Payable

9.Common Stock

10.Dividends

11.Fees Earned

12.Wages Expense

13.Rent Expense

14.Utilities Expense

15.Truck Expense

16.Miscellaneous Expense

Prepaid Insurance

An asset account that reflects the amount paid for insurance policies in advance, before the coverage period begins.

Accounts Receivable

Financial obligations customers have to a business for received services or goods that have not been paid for.

Miscellaneous Expense

Expenses that do not fit into any specific category of the business's financial statements, often small or infrequent costs.

- Accomplish the process of entering journals for a range of business transactions, using the double-entry accounting technique.

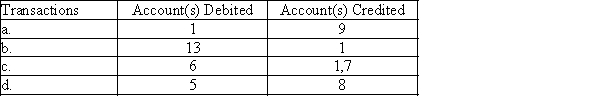

Verified Answer

AT

Learning Objectives

- Accomplish the process of entering journals for a range of business transactions, using the double-entry accounting technique.