Asked by Aamir Anwar on May 07, 2024

Verified

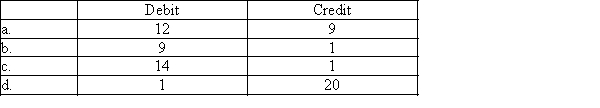

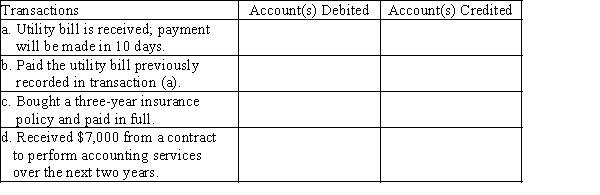

Listed below are accounts to use for transactions (a) through (d), each identified by a number. Following this list are the transactions. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number(s) in the appropriate box.

1.Cash

2.Accounts Receivable

3.Office Supplies

4.Land

5.Interest Receivable

6.Building

7.Truck

8.Equipment

9.Accounts Payable

10.Interest Payable

11.Insurance Payable

12.Utilities Expense

13.Notes Payable

14.Prepaid Insurance

15.Service Revenue

16.Common Stock

17.Insurance Expense

18.Interest Expense

19.Office Supplies Expense

20.Unearned Service Revenue

21.Dividends

Interest Receivable

An accounting term referring to the interest income that has been earned but not yet received in cash.

Accounts Payable

Liabilities of a business that represent amounts due to suppliers or creditors for goods and services received but not yet paid for.

Equipment

Tangible assets used in the operation of a business, such as machinery and office furniture, which are not intended for sale.

- Perform journal entries for various business transactions, applying the double-entry bookkeeping system.

Verified Answer

Learning Objectives

- Perform journal entries for various business transactions, applying the double-entry bookkeeping system.

Related questions

On January 12, JumpStart Co ...

On January 1, Merry Walker and Other Stockholders Established a ...

Which of the Following Describes the Transaction Resulting in a ...

Information May Be Accessed Almost Instantly and Made Available to ...

Formatted Screens and Built-In Databases of Patient Accounts and Vendors ...