Asked by Kaiulani Waikiki on Jun 06, 2024

Verified

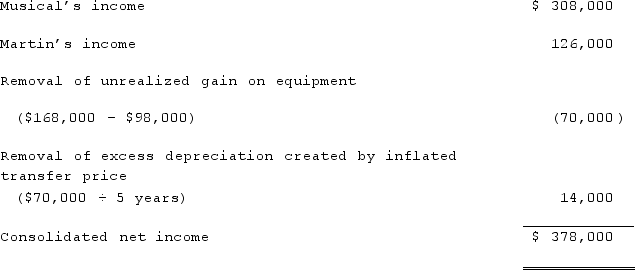

On January 1, 2021, Musical Corp. sold equipment to Martin Inc. (a wholly-owned subsidiary) for $168,000 in cash. The equipment originally cost $140,000 but had a book value of only $98,000 when transferred. On that date, the equipment had a five-year remaining life. Depreciation expense was calculated using the straight-line method.Musical earned $308,000 in net income in 2021 (not including any investment income) while Martin reported $126,000. Assume there is no amortization related to the original investment.What is consolidated net income for 2021?

Consolidated Net Income

The total net income of a parent company and its subsidiaries after eliminating intercompany transactions and minority interests.

Depreciation Expense

The methodical distribution of the expense of a physical asset across its lifespan, representing its depreciation or loss of value due to aging or becoming outdated.

Straight-Line Method

A technique for computing depreciation or amortization by uniformly distributing an asset's cost throughout its expected lifespan.

- Compute the net earnings attributed to the minority interest within a consolidated entity.

- Examine the impact of equipment sales within the same entity on both depreciation and the overall net income after consolidation.

Verified Answer

VD

Learning Objectives

- Compute the net earnings attributed to the minority interest within a consolidated entity.

- Examine the impact of equipment sales within the same entity on both depreciation and the overall net income after consolidation.