Asked by Yolanda Albino on May 22, 2024

Verified

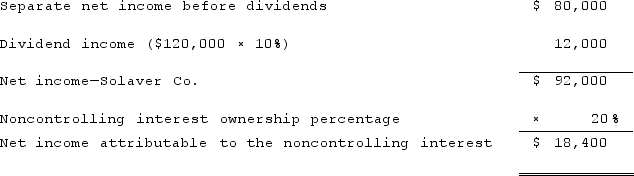

Jull Corp. owned 80% of Solaver Co. Solaver paid $250,000 for 10% of Jull's common stock. In 2021, Jull and Solaver reported separate net incomes (not including income from the investment) of $300,000 and $80,000, respectively. Jull and Solaver declared dividends of $120,000 and $50,000, respectively.Required:Under the treasury stock approach, what is the net income attributable to the noncontrolling interest?

Treasury Stock Approach

A method of accounting for repurchased shares of a company's own stock, treating them as treasury stock and reducing the company's equity.

Noncontrolling Interest

The portion of equity in a subsidiary not attributable to the parent company, representing outside investors' ownership.

Net Income

The total earnings of a company after subtracting all expenses from revenue.

- Compute and elucidate net income designated for both majority and minority stakeholders.

Verified Answer

AG

Learning Objectives

- Compute and elucidate net income designated for both majority and minority stakeholders.