Asked by WillIam Cunkle on May 10, 2024

Verified

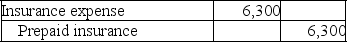

On January 1,2019,the balance in the prepaid insurance account was $2,500.On December 31,2019,after the 2019 adjusting entries were made,the balance of the prepaid insurance account was $1,200.During 2019,cash payments for insurance premiums amounted to $5,000,which was debited to the prepaid insurance account.Prepare the adjusting entry,which must have been made at December 31,2019.

Adjusting Entries

Journal records created at the close of an accounting cycle to distribute revenues and costs to the period they truly happened in.

Prepaid Insurance

The portion of insurance premiums that has been paid in advance and is considered a current asset on the balance sheet because it provides future economic benefits.

Cash Payments

Transactions that involve the transfer of currency or check from one party to another as a form of payment.

- Understand the process for preparing adjusting entries in accounting.

- Analyze the effects of adjusting entries on financial statements.

Verified Answer

Learning Objectives

- Understand the process for preparing adjusting entries in accounting.

- Analyze the effects of adjusting entries on financial statements.

Related questions

Johnson Corporation Is Completing the Accounting Information Processing Cycle at ...

If the Effect of the Debit Portion of an Adjusting ...

At January 31, the End of the First Month of ...

Prior to Adjustment on August 31, Salary Expense Has a ...

You Have Just Accepted Your First Job Out of College ...

$2,500 + $5,000 - $1,200 = $6,300

$2,500 + $5,000 - $1,200 = $6,300