Asked by Anthony Jones on May 08, 2024

Verified

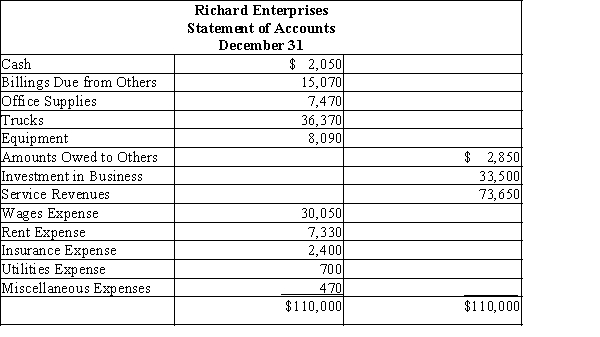

You have just accepted your first job out of college, which requires you to evaluate loan requests at Eastwood National Bank. The first loan request you receive is from Richard Enterprises. Richard Tracy, the CEO, is requesting $105,000 and brings you the following trial balance (or statement of accounts) for the first year of operations ended December 31.Which of the following accounts do you think might need to be adjusted before an accurate set of financial statements could be prepared?

Trial Balance

A bookkeeping report that lists the balances of all ledgers accounts in order to verify that total debits equal total credits.

Financial Statements

Formal records of an entity's financial activities and conditions, including the balance sheet, income statement, and cash flow statement.

Loan Requests

Applications submitted by individuals or entities to a lender, requesting the borrowing of a certain amount of money.

- Acquire knowledge of and apply adjustments in accounting entries.

- Present and develop a structured balance sheet.

Verified Answer

OO

Osahon OgbomoMay 11, 2024

Final Answer :

The following adjustments might be necessary before an accurate set of financial statements can be prepared:

∙

No office supplies expense is shown. The office supplies account should be adjusted for the supplies used during the year.∙

No depreciation expense is shown for the trucks or equipment accounts. An adjusting entry should be prepared for depreciation expense on each of these assets.∙

An inquiry should be made as to whether any accrued expenses, such as wages or utilities, exist at the end of the year.∙

An inquiry should be made as to whether any prepaid expenses, such as rent or insurance, exist at the end of the year.∙

An inquiry should be made as to whether any unearned revenue exists at the end of the year.

∙

No office supplies expense is shown. The office supplies account should be adjusted for the supplies used during the year.∙

No depreciation expense is shown for the trucks or equipment accounts. An adjusting entry should be prepared for depreciation expense on each of these assets.∙

An inquiry should be made as to whether any accrued expenses, such as wages or utilities, exist at the end of the year.∙

An inquiry should be made as to whether any prepaid expenses, such as rent or insurance, exist at the end of the year.∙

An inquiry should be made as to whether any unearned revenue exists at the end of the year.

Learning Objectives

- Acquire knowledge of and apply adjustments in accounting entries.

- Present and develop a structured balance sheet.