Asked by Sonia Sheikh on Jul 24, 2024

Verified

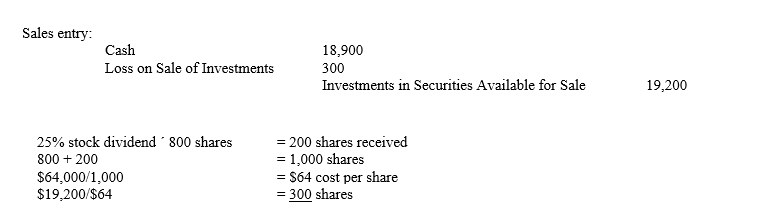

On January 1, 2010, Antlers, Inc.bought 800 shares (or 10%)of Buck Company's stock at $80.On February 1, 2010, Buck Company declared a 25% stock dividend.On March 1, 2010, Antlers sold several shares of Buck Company stock for $18, 900, realizing a loss of $300.

Required:

Show the journal entry to record the sale, and compute the number of shares of Buck Company stock that Antlers, Inc., sold.

Stock Dividend

A stock dividend is a dividend payment made to shareholders in the form of additional shares rather than a cash payout, affecting the company's share price and equity structure.

Journal Entry

A journal entry is a recording of a financial transaction in the accounting records of a business, indicating debts and credits to various accounts.

Realizing A Loss

Realizing a loss occurs when an asset is sold for less than its purchase price or book value, officially recognizing the loss in financial records.

- Identify the methods for computing profits or deficits incurred through the sale of tradable financial instruments.

Verified Answer

Learning Objectives

- Identify the methods for computing profits or deficits incurred through the sale of tradable financial instruments.

Related questions

On January 1, 2010, Lightner Bought 20, 000 Shares (5 ...

Ruben Company Purchased $100,000 of Evans Company Bonds at 100 ...

Posthorn Corporation Acquired 20,000 of the 100,000 Outstanding Common Shares ...

An Investor Purchased 500 Shares of Common Stock, $25 Par ...

An Unrealized Loss on Trading Securities Is Reported Under Other ...