Asked by Herantha Wickramasekera on Apr 26, 2024

Verified

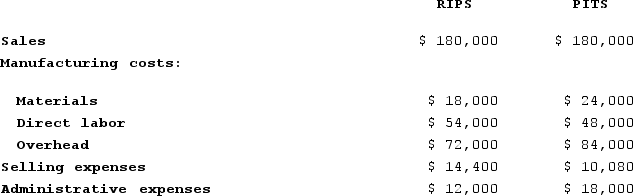

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS. Production is "for order" only, and no finished goods inventories are maintained; work in process inventories are negligible. The following data relate to last month's operations:

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed. The balance of the overhead is variable. Selling expenses consist entirely of commissions paid as a percentage of sales. Direct labor is completely variable. Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed. The balance of the overhead is variable. Selling expenses consist entirely of commissions paid as a percentage of sales. Direct labor is completely variable. Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

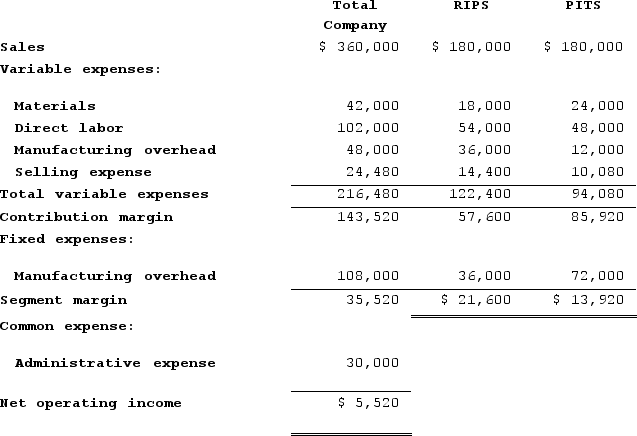

Prepare a segmented income statement, in total and for the two products. Use the contribution approach.

Segmented Income Statement

An income statement that separates costs and revenues into different segments, departments, or divisions of a business.

Contribution Approach

An income statement format that organizes costs by their behavior. Costs are separated into variable and fixed categories rather than being separated into product and period costs for external reporting purposes.

Manufacturing Overhead

All indirect costs related to manufacturing that cannot be directly traced to specific items produced, such as factory rent, utilities, and equipment depreciation.

- Formulate divided earnings reports and comprehend their significance in guiding managerial choices.

- Analyze the cost structure of products and understand fixed and variable cost behaviors.

Verified Answer

Learning Objectives

- Formulate divided earnings reports and comprehend their significance in guiding managerial choices.

- Analyze the cost structure of products and understand fixed and variable cost behaviors.

Related questions

The Carlsbad Corporation Produces and Markets Two Types of Electronic ...

Omstadt Corporation Produces and Sells Only Two Products That Are ...

Fausnaught Corporation Has Two Major Business Segments--Retail and Wholesale ...

Ieso Corporation Has Two Stores: J and K ...

A Properly Constructed Segmented Income Statement in a Contribution Format ...