Asked by Bradley Fabretti on Jul 28, 2024

Verified

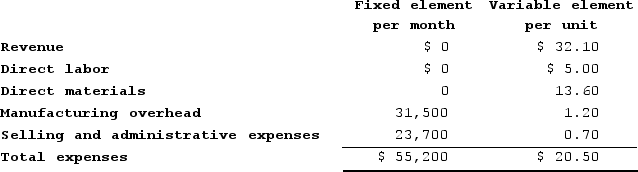

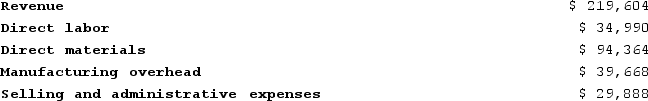

Manter Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During June, the company budgeted for 6,900 units, but its actual level of activity was 6,940 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for June:Data used in budgeting:  Actual results for June:

Actual results for June:

The selling and administrative expenses in the planning budget for June would be closest to:

The selling and administrative expenses in the planning budget for June would be closest to:

A) $29,716

B) $28,530

C) $29,888

D) $28,558

Units

Basic quantities or entities used as a standard of measurement for inventory, production, or other business processes.

Selling and Administrative Expenses

Costs that are not directly tied to the production of goods or services, including marketing expenses, salaries of sales personnel, and management salaries.

- Calculate and clarify the significance of net operating income within the context of flexible and planning budgets.

Verified Answer

HL

holden landryJul 30, 2024

Final Answer :

B

Explanation :

The selling and administrative expenses in the planning budget for June can be calculated using the following formula:

Budgeted Selling and Administrative Expenses = Budgeted Selling and Administrative cost per unit * Budgeted units

In the given data, the budgeted units are 6,900 and the budgeted selling and administrative cost per unit is $4.32. Therefore,

Budgeted Selling and Administrative Expenses = $4.32 * 6,900 = $29,808

The actual selling and administrative expenses in June were $28,530.

Since the company uses the same cost per unit formula to calculate both the budgeted and actual selling and administrative expenses, we can use this formula to calculate the budgeted selling and administrative expenses based on the actual level of activity.

Actual Selling and Administrative expenses = Actual units * Budgeted Selling and Administrative cost per unit

Substituting the actual data in this formula, we get:

$28,530 = 6,940 * Budgeted Selling and Administrative cost per unit

Therefore, Budgeted Selling and Administrative cost per unit = $28,530 / 6,940 = $4.11

Using this cost per unit, we can calculate the budgeted selling and administrative expenses for the actual level of activity:

Budgeted Selling and Administrative Expenses = $4.11 * 6,900 = $28,359

Therefore, the selling and administrative expenses in the planning budget for June would be closest to $28,530. (Option B)

Budgeted Selling and Administrative Expenses = Budgeted Selling and Administrative cost per unit * Budgeted units

In the given data, the budgeted units are 6,900 and the budgeted selling and administrative cost per unit is $4.32. Therefore,

Budgeted Selling and Administrative Expenses = $4.32 * 6,900 = $29,808

The actual selling and administrative expenses in June were $28,530.

Since the company uses the same cost per unit formula to calculate both the budgeted and actual selling and administrative expenses, we can use this formula to calculate the budgeted selling and administrative expenses based on the actual level of activity.

Actual Selling and Administrative expenses = Actual units * Budgeted Selling and Administrative cost per unit

Substituting the actual data in this formula, we get:

$28,530 = 6,940 * Budgeted Selling and Administrative cost per unit

Therefore, Budgeted Selling and Administrative cost per unit = $28,530 / 6,940 = $4.11

Using this cost per unit, we can calculate the budgeted selling and administrative expenses for the actual level of activity:

Budgeted Selling and Administrative Expenses = $4.11 * 6,900 = $28,359

Therefore, the selling and administrative expenses in the planning budget for June would be closest to $28,530. (Option B)

Learning Objectives

- Calculate and clarify the significance of net operating income within the context of flexible and planning budgets.

Related questions

Paulis Kennel Uses Tenant-Days as Its Measure of Activity; an ...

Neeb Corporation Manufactures and Sells a Single Product ...

Meinke Kennel Uses Tenant-Days as Its Measure of Activity; an ...

Meinke Kennel Uses Tenant-Days as Its Measure of Activity; an ...

Gordin Kennel Uses Tenant-Days as Its Measure of Activity; an ...