Asked by Taven Lange on May 17, 2024

Verified

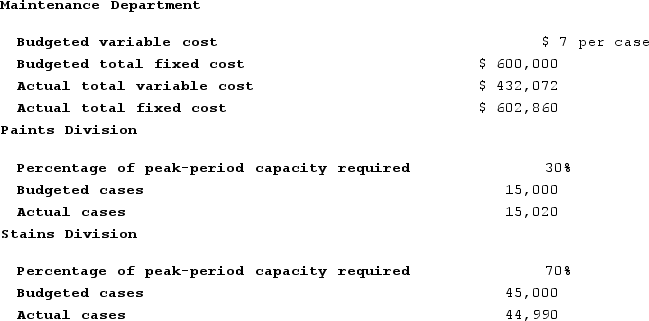

Nealon Corporation's Maintenance Department provides services to the company's two operating divisions--the Paints Division and the Stains Division. The variable costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments. The fixed costs of the Maintenance Department are determined based on the number of cases produced by the operating departments during the peak-period. Data appear below:

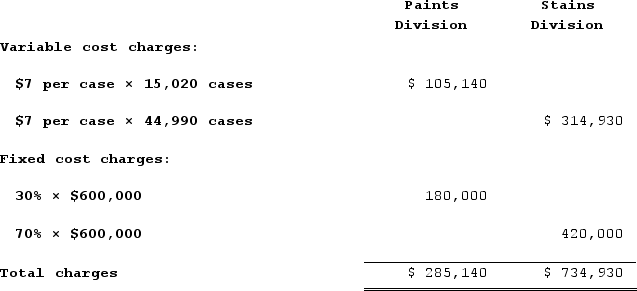

Required:a. Prepare a report showing how much of the Maintenance Department's costs should be charged to each of the operating divisions at the end of the year. b. How much of the actual Maintenance Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Required:a. Prepare a report showing how much of the Maintenance Department's costs should be charged to each of the operating divisions at the end of the year. b. How much of the actual Maintenance Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Maintenance Department

A division within a company responsible for maintaining equipment, facilities, and systems in working order.

Operating Divisions

Distinct areas within a company that are responsible for different operations, products, or markets, often treated as separate business units.

Fixed Costs

Costs that do not vary with the level of production or sales, such as rent, salaries, and insurance premiums, and are inevitable regardless of business activity.

- Evaluate the influence of variable and fixed expenses on determining internal transfer pricing and charges between divisions.

- Cultivate abilities related to financial reporting for internal sectors and branches, encompassing the distribution of costs and accountability in accounting.

Verified Answer

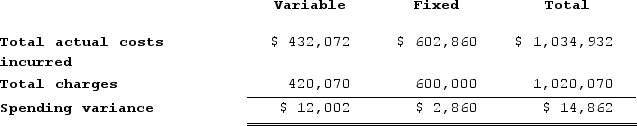

b.The uncharged costs are:

b.The uncharged costs are: The spending variance represents the difference between the Maintenance Department's actual costs and what those costs should have been, given the actual level of activity. This difference is the responsibility of the Maintenance Department and should not be charged to the operating divisions.

The spending variance represents the difference between the Maintenance Department's actual costs and what those costs should have been, given the actual level of activity. This difference is the responsibility of the Maintenance Department and should not be charged to the operating divisions.

Learning Objectives

- Evaluate the influence of variable and fixed expenses on determining internal transfer pricing and charges between divisions.

- Cultivate abilities related to financial reporting for internal sectors and branches, encompassing the distribution of costs and accountability in accounting.

Related questions

Sauseda Corporation Has Two Operating Divisions-An Inland Division and a ...

Leslie Company Operates a Cafeteria for the Benefit of Its ...

Cannata Corporation Has Two Operating Divisions--A North Division and a ...

Sauseda Corporation Has Two Operating Divisions--An Inland Division and a ...

Shular Products, Incorporated, Has a Valve Division That Manufactures and ...