Asked by Krista Hageman on Jun 12, 2024

Verified

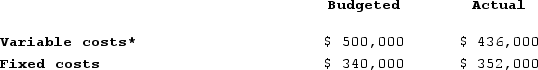

Leslie Company operates a cafeteria for the benefit of its employees. The company subsidizes the cafeteria heavily by allowing employees to purchase meals at greatly reduced prices. Budgeted and actual costs in the cafeteria for the year just ended are as follows:

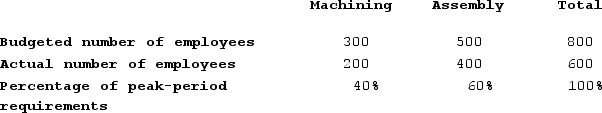

*Unrecovered cost after deducting amounts received from employees.Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the percentage of peak-period requirements. Data concerning the company's producing departments follows:

*Unrecovered cost after deducting amounts received from employees.Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the percentage of peak-period requirements. Data concerning the company's producing departments follows:

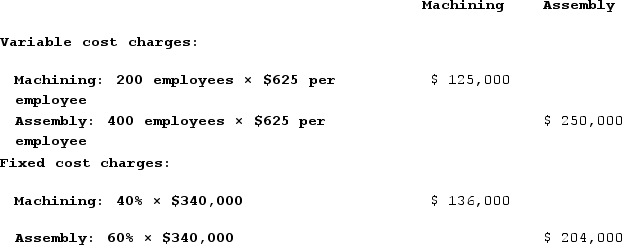

Required: a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.b. Identify the amount, if any, of actual costs that should not be charged to the operating departments.

Required: a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.b. Identify the amount, if any, of actual costs that should not be charged to the operating departments.

Producing Departments

Sections within a manufacturing facility where raw materials are processed or assembled into finished products.

Fixed Costs

Costs that do not change with the level of output or sales, such as rent, salaries, and insurance premiums.

Cafeteria

A type of food service location within an establishment where customers serve themselves from a variety of options.

- Appraise the significance of variable and fixed outlays in setting prices for internal transfers and fees among divisions.

- Build competence in financial reporting within organizational divisions, including the principles of cost allocation and responsibility accounting.

Verified Answer

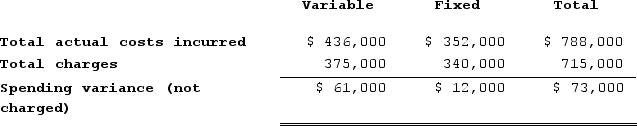

b.The remaining amounts of variable and fixed costs are variances that should not be charged:

b.The remaining amounts of variable and fixed costs are variances that should not be charged:

Learning Objectives

- Appraise the significance of variable and fixed outlays in setting prices for internal transfers and fees among divisions.

- Build competence in financial reporting within organizational divisions, including the principles of cost allocation and responsibility accounting.

Related questions

Gabritz, Incorporated Has a Maintenance Department That Provides Services to ...

Shular Products, Incorporated, Has a Valve Division That Manufactures and ...

Leslie Company Operates a Cafeteria for the Benefit of Its ...

Sauseda Corporation Has Two Operating Divisions-An Inland Division and a ...

Sauseda Corporation Has Two Operating Divisions--An Inland Division and a ...