Asked by Ashram Maharaj on Jul 29, 2024

Verified

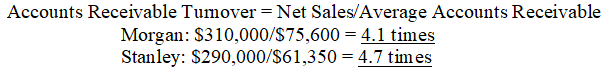

Morgan had net sales of $310,000 and average accounts receivable of $75,600.Its competitor,Stanley,had net sales of $290,000 and average accounts receivables of $61,350.Calculate the accounts receivable turnover for both companies.Which company is doing a better job of managing its accounts receivables?

Accounts Receivable Turnover

A financial ratio that measures how efficiently a company collects cash from its credit sales by dividing net credit sales by the average accounts receivable.

Net Sales

The net income generated from sales, after subtracting the costs related to returns, compensations for damaged or lost items, and price reductions.

Average Accounts Receivable

A measure of the average amount of money owed to a company by its customers over a period.

- Determine and scrutinize the accounts receivable turnover ratio.

- Analyze financial results using accounts receivable turnover to assess company performance in managing receivables.

Verified Answer

Stanley has a higher accounts receivable turnover.This implies it is doing a better job of managing its receivables than Morgan.

Stanley has a higher accounts receivable turnover.This implies it is doing a better job of managing its receivables than Morgan.

Learning Objectives

- Determine and scrutinize the accounts receivable turnover ratio.

- Analyze financial results using accounts receivable turnover to assess company performance in managing receivables.

Related questions

What Are Some of the Considerations Management Should Make When ...

What Is the Accounts Receivable Turnover Ratio? How Is It ...

A Company Reports the Following Results in Its Financial Statements ...

Flax Had Net Sales of $7,875 and Its Average Accounts ...

Tecom Had Net Sales of $315,000 and Average Accounts Receivable ...