Asked by David Plata on Jun 16, 2024

Verified

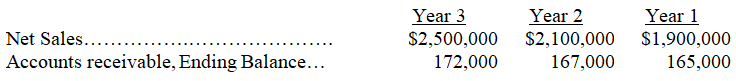

A company reports the following results in its financial statements:

Calculate the company accounts receivable turnover for Year 2 and Year 3.Compare these two results and give a possible explanation for any significant change.

Calculate the company accounts receivable turnover for Year 2 and Year 3.Compare these two results and give a possible explanation for any significant change.

Accounts Receivable Turnover

A financial metric indicating how quickly a company collects on its accounts receivable.

Financial Statements

Papers that give a summary of a corporation's financial status, featuring the balance sheet, income statement, and statement of cash flows.

- Compute and evaluate the turnover rate of accounts receivable.

- Apply accounts receivable turnover analysis to review financial achievements, judging company aptitude in handling receivables.

Verified Answer

MG

Matthew gerriorJun 19, 2024

Final Answer :

Year 2: Accounts receivable turnover:

$2,100,000/[($165,000+$167,000)/ 2] = 12.7 times

Year 3: Accounts receivable turnover:

$2,500,000/[($167,000+$172,000)/ 2] = 14.7 times

The company's accounts receivable turnover has increased from 12.7 in Year 2 to 14.7 in Year 3.This increase in accounts receivable turnover may indicate that the company has tightened its credit policy or that it has improved on its collection efforts regarding receivables.

$2,100,000/[($165,000+$167,000)/ 2] = 12.7 times

Year 3: Accounts receivable turnover:

$2,500,000/[($167,000+$172,000)/ 2] = 14.7 times

The company's accounts receivable turnover has increased from 12.7 in Year 2 to 14.7 in Year 3.This increase in accounts receivable turnover may indicate that the company has tightened its credit policy or that it has improved on its collection efforts regarding receivables.

Learning Objectives

- Compute and evaluate the turnover rate of accounts receivable.

- Apply accounts receivable turnover analysis to review financial achievements, judging company aptitude in handling receivables.

Related questions

What Is the Accounts Receivable Turnover Ratio? How Is It ...

What Are Some of the Considerations Management Should Make When ...

Morgan Had Net Sales of $310,000 and Average Accounts Receivable ...

Flax Had Net Sales of $7,875 and Its Average Accounts ...

Hasbro Had Net Sales of $7,875 and Its Average Accounts ...