Asked by Emily Yannatone on Jul 15, 2024

Verified

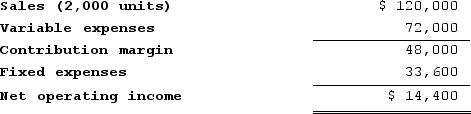

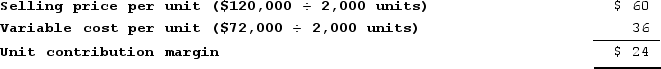

Montesdeoca Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range.

Required:

Required:

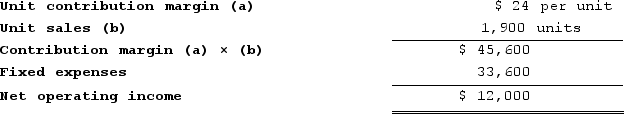

a. If sales decline to 1,900 units, what would be the estimated net operating income?

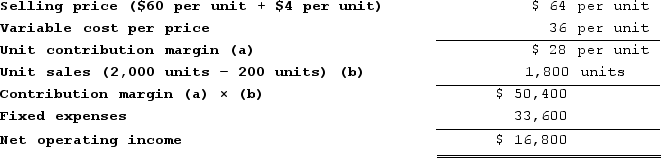

b. If the selling price increases by $4 per unit and the sales volume decreases by 200 units, what would be the estimated net operating income?

c. What is the break-even point in dollar sales?

Contribution Format Income Statement

An income statement layout that separates variable costs from fixed costs, showing the contribution margin and highlighting how sales revenue covers variable costs and fixed costs to determine net income.

Break-even Point

This refers to the level of production or sales volume at which total revenues match total expenses, resulting in no net profit or loss.

Net Operating Income

A financial metric indicating the profitability of a business's core operations, calculated by subtracting operating expenses from gross income.

- Project the net operational profit through the scrutiny of sales volume differences, selling price changes, variable economic obligations, and fixed expenses.

- Calculate the equilibrium point quantified by both units and financial terms.

Verified Answer

c. CM ratio = Contribution margin ÷ Sales = $48,000 ÷ $120,000 = 40%

Dollar sales to break even = Fixed expenses ÷ CM ratio = $33,600 ÷ 40% = $84,000

Learning Objectives

- Project the net operational profit through the scrutiny of sales volume differences, selling price changes, variable economic obligations, and fixed expenses.

- Calculate the equilibrium point quantified by both units and financial terms.

Related questions

Giannini Incorporated, Which Produces and Sells a Single Product, Has ...

Sattler Corporation Has Provided the Following Contribution Format Income Statement ...

Mechem Corporation Produces and Sells a Single Product ...

Naumann Corporation Produces and Sells a Single Product ...

Sarratt Corporation's Contribution Margin Ratio Is 73% and Its Fixed ...