Asked by Kayli Cooper on Jun 09, 2024

Verified

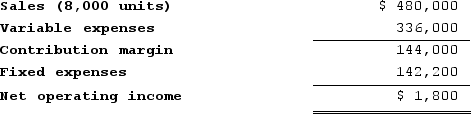

Sattler Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range.

Required:

Required:

a. What is the contribution margin per unit?

b. What is the variable expense ratio?

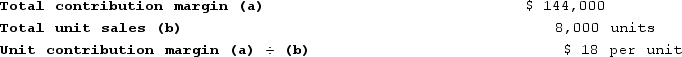

c. If sales decline to 7,900 units, what would be the estimated net operating income?

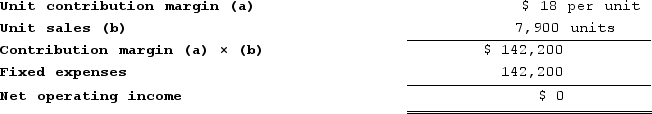

d. If the variable cost per unit increases by $5, spending on advertising increases by $2,000, and unit sales increase by 3,400 units, what would be the estimated net operating income?

e. What is the break-even point in dollar sales?

f. Estimate how many units must be sold to achieve a target profit of $50,400.

g. What is the margin of safety percentage?

h. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 15% increase in sales volume?

Contribution Margin

The amount by which a product's selling price exceeds its total variable costs, used to cover fixed costs and contribute to net profits.

Variable Expense Ratio

A financial metric that represents the proportion of variable expenses to sales revenue, indicating how much variable costs change in response to sales activity.

Break-even Point

The level of production or sales at which total costs equal total revenue, resulting in no net loss or gain.

- Interpret and appraise the role of contribution margin income statements in financial analysis.

- Compute the per unit contribution margin, the contribution margin ratio, and the variable expense ratio.

- Forecast the operational net gain by examining trends in sales quantity, pricing adjustments, variable outgoings, and constant charges.

Verified Answer

b. Variable expense ratio = Variable expenses ÷ Sales = $336,000 ÷ $480,000 = 70%

c.

d.

e. Dollar sales to break even = Fixed expenses ÷ CM ratio = $142,200 ÷ 30% = $474,000

f. Unit sales to attain a target profit = (Target profit + Fixed expenses) ÷ Unit CM

= ($50,400 + $142,200) ÷ $18 per unit = $192,600÷ $18 per unit = 10,700 units

g. Margin of safety percentage = Margin of safety in dollars ÷ Total budgeted (or actual) sales

= $6,000 ÷ $480,000 = 1%

h. Percentage change in net operating income = Degree of operating leverage × Percentage change in sales

= 80.0 × 15% = 1200%

Learning Objectives

- Interpret and appraise the role of contribution margin income statements in financial analysis.

- Compute the per unit contribution margin, the contribution margin ratio, and the variable expense ratio.

- Forecast the operational net gain by examining trends in sales quantity, pricing adjustments, variable outgoings, and constant charges.

Related questions

Sun Corporation Has Provided the Following Contribution Format Income Statement ...

Naumann Corporation Produces and Sells a Single Product ...

Sarratt Corporation's Contribution Margin Ratio Is 73% and Its Fixed ...

Mechem Corporation Produces and Sells a Single Product ...

Giannini Incorporated, Which Produces and Sells a Single Product, Has ...