Asked by Lauren Allysé on May 27, 2024

Verified

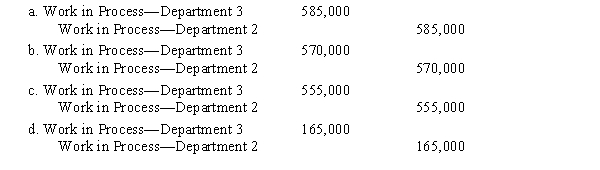

Mocha Company manufactures a single product by a continuous process involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. Work in process at the beginning of the period for Department 1 was $75,000, and work in process at the end of the period totaled $60,000. The records indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $50,000, $60,000, and $70,000, respectively. In addition, work in process at the beginning of the period for Department 2 totaled $75,000, and work in process at the end of the period totaled $60,000. The journal entry to record the flow of costs into Department 3 during the period is

Applied Factory Overhead

The allocation of manufacturing overhead costs to actual production, based on a predetermined rate or formula.

Continuous Process

A production process that operates continuously without interruption to manufacture products or process materials in an unending flow.

Work In Process

The cost of unfinished goods in the manufacturing process at a given time, including labor, material, and overhead.

- Comprehend and document the movement of expenses in production sectors.

- Appreciate the roles of direct materials, direct labor, and allocated overhead in product cost calculation.

Verified Answer

AD

Learning Objectives

- Comprehend and document the movement of expenses in production sectors.

- Appreciate the roles of direct materials, direct labor, and allocated overhead in product cost calculation.