Asked by Julia Kochman on May 12, 2024

Verified

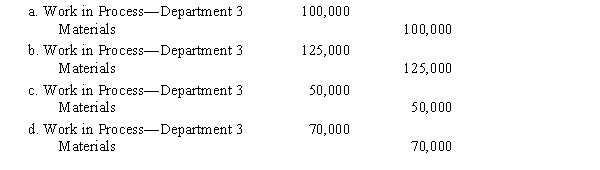

Mocha Company manufactures a single product by a continuous process involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 3 were $50,000, $60,000, and $70,000, respectively. In addition, work in process at the beginning of the period for Department 3 totaled $75,000, and work in process at the end of the period totaled $60,000. The journal entry to record the flow of costs into Department 3 during the period for direct materials is

Applied Factory Overhead

The allocation of estimated overhead costs to individual units of production based on a predetermined rate.

Continuous Process

A manufacturing process where raw materials are continuously fed into the production system, and products are continuously outputted.

Work In Process

An accounting category representing partially completed goods awaiting completion and sale.

- Understand the importance of direct materials, direct labor, and allocated overhead in the computation of product costs.

Verified Answer

BS

Learning Objectives

- Understand the importance of direct materials, direct labor, and allocated overhead in the computation of product costs.