Asked by Joshua Davis on Jun 17, 2024

Verified

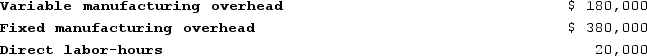

Mcniff Corporation makes a range of products. The company's predetermined overhead rate is $28 per direct labor-hour, which was calculated using the following budgeted data:

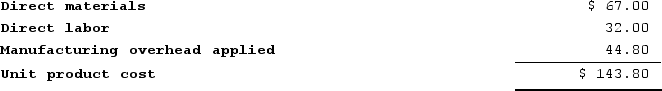

Management is considering a special order for 200 units of product O96S at $122 each. The normal selling price of product O96S is $149 and the unit product cost is determined as follows:

Management is considering a special order for 200 units of product O96S at $122 each. The normal selling price of product O96S is $149 and the unit product cost is determined as follows:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:The financial advantage (disadvantage) for the company as a result of accepting this special order would be:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:The financial advantage (disadvantage) for the company as a result of accepting this special order would be:

Predetermined Overhead Rate

A rate calculated before a period begins, based on the estimated overhead costs and estimated level of activity, used to allocate overhead to products or services.

Direct Labor-hour

The unit of measure for the time a worker spends on a specific task directly related to the production of goods, reiterated as "The specific hours worked by employees directly contributing to product creation."

Special Order

A one-time customer order often requiring unique specifications and possibly a different pricing structure.

- Analyze special orders and their impact on profitability and production capacity.

Verified Answer

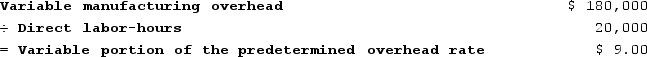

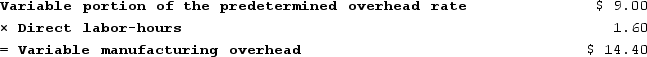

The direct-labor hours per unit for the special order can be determined as follows:

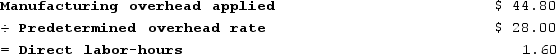

The direct-labor hours per unit for the special order can be determined as follows: Consequently, the variable manufacturing overhead for the special order would be:

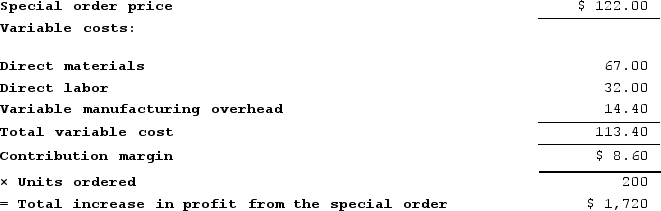

Consequently, the variable manufacturing overhead for the special order would be: Putting this all together:

Putting this all together:

Learning Objectives

- Analyze special orders and their impact on profitability and production capacity.

Related questions

A Customer Has Asked Lalka Corporation to Supply 3,000 Units ...

Piper Rose Boutique Has Been Approached by the Community College ...

Markson Company Had the Following Results of Operations for the ...

The Company Has Received a Special, One-Time-Only Order for 400 ...

Variations Company Had the Following Results of Operations for the ...