Asked by Celina Singh on Jul 29, 2024

Verified

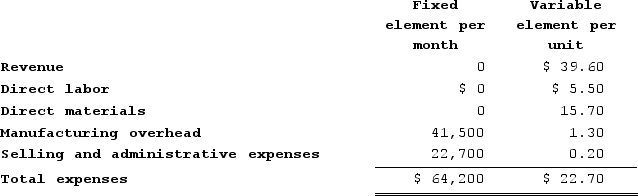

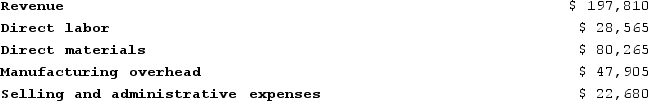

Lenci Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During May, the company budgeted for 5,100 units, but its actual level of activity was 5,050 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for May:Data used in budgeting:  Actual results for May:

Actual results for May:

The overall revenue and spending variance (i.e., the variance for net operating income in the revenue and spending variance column on the flexible budget performance report) for May would be closest to:

The overall revenue and spending variance (i.e., the variance for net operating income in the revenue and spending variance column on the flexible budget performance report) for May would be closest to:

A) $3,595 F

B) $2,750 F

C) $2,750 U

D) $3,595 U

Revenue and Spending Variance

The difference between the budgeted and actual amounts of revenue and expenditure over a specific period.

Net Operating Income

Income from a company's core business operations, excluding deductions of interest and taxes.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity levels of the business, allowing for more accurate budgeting and performance evaluation.

- Assess the variability of net operating income and explain its implications for financial analysis.

Verified Answer

Actual net operating income = Actual sales revenue - Actual total costs = $69,190 - $45,350 = $23,840

Flexible budget net operating income = Budgeted selling price per unit x Actual units sold - Budgeted variable cost per unit x Actual units sold - Budgeted fixed cost = ($120 x 5,050) - ($68 x 5,050) - $13,200 = $606,000 - $343,400 - $13,200 = $249,400

Overall revenue and spending variance = Actual net operating income - Flexible budget net operating income = $23,840 - $249,400 = $225,560 U or unfavorable

Note that the revenue variance is computed as the difference between the actual sales revenue and the flexible budget sales revenue, and the spending variance is computed as the difference between the actual total costs and the flexible budget total costs. The revenue variance is $3,595 F and the spending variance is $228,155 U. The overall revenue and spending variance is the sum of these two variances, which is $225,560 U.

Learning Objectives

- Assess the variability of net operating income and explain its implications for financial analysis.

Related questions

Bernes Kennel Uses Tenant-Days as Its Measure of Activity; an ...

The Net Operating Income in the Flexible Budget for December ...

The Net Operating Income in the Flexible Budget for November ...

The Net Operating Income in the Flexible Budget for January ...

The Following Information Has Been Provided by Flatiron Company for ...