Asked by Eveleen Zapata on Jul 12, 2024

Verified

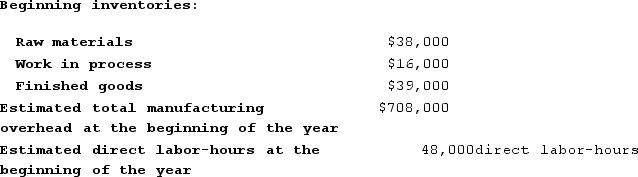

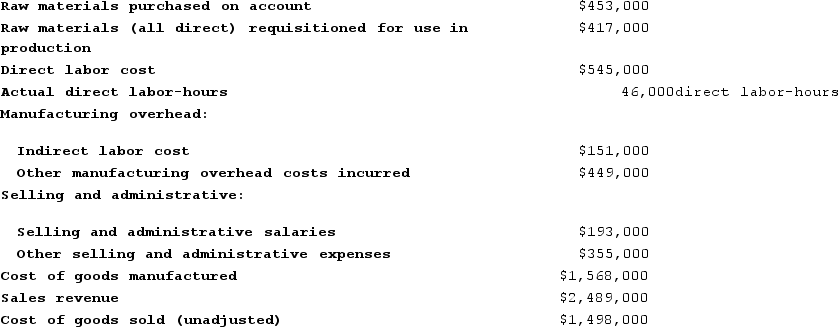

Kahanaoi Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year:

Results of operations:

Results of operations:

Required:

Required:

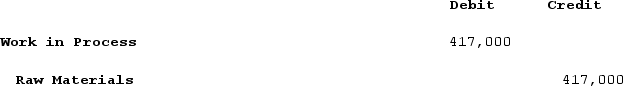

a. What is the journal entry to record raw materials used in production?

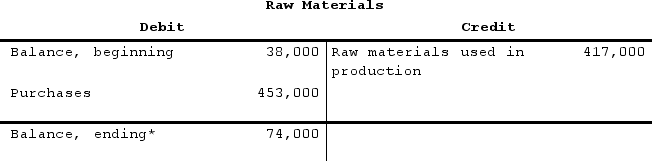

b. What is the ending balance in Raw Materials?

c. What is the journal entry to record the direct and indirect labor costs incurred during the year?

d. What is the total amount of manufacturing overhead applied to production during the year?

e. What is the total manufacturing cost added to Work in Process during the year?

f. What is the journal entry to record the transfer of completed goods from Work in Process to Finished Goods?

g. What is the ending balance in Work in Process?

h. Is manufacturing overhead overapplied or underapplied for the year? By how much?

i. What is the cost of goods available for sale during the year?

j. What is the journal entry to record the unadjusted cost of goods sold?

k. What is the adjusted cost of goods sold for the year?

l. What is the gross margin for the year?

m. What is the net operating income for the year?

Job-Order Costing

An accounting method that assigns costs to specific jobs or batches, which is especially useful for companies producing distinct products or jobs.

Direct Labor

The cost of wages for employees who are directly involved in the production of goods or services.

- Learn about the system for recording the obtaining and application of raw materials in production settings.

- Compute the cost of direct materials utilizing the given data.

- Discern and allocate manufacturing overhead that is either under or over applied.

Verified Answer

LR

LoAnnie RodriguezJul 15, 2024

Final Answer :

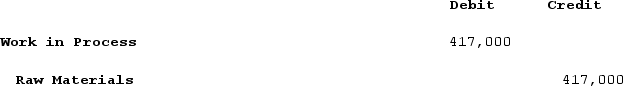

a. The journal entry to record the raw materials used in production is:

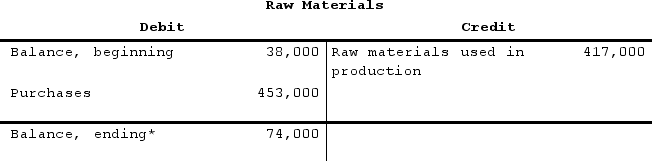

b. The ending balance in Raw Materials is computed as follows:

*38,000 + 453,000 − 417,000 = 74,000

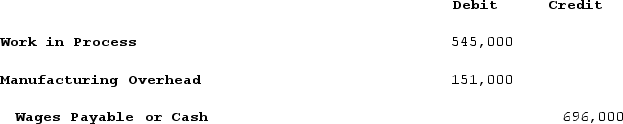

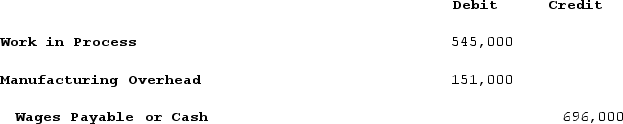

c. The journal entry to record the direct and indirect labor costs is:

d. The total manufacturing overhead applied to production is computed as follows:

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base

= $708,000 ÷ 48,000 direct labor-hours = $14.75 per direct labor-hour

Overhead applied = Predetermined overhead rate × Amount of the allocation base incurred

= $14.75 per direct labor-hour × 46,000 direct labor-hours = $678,500

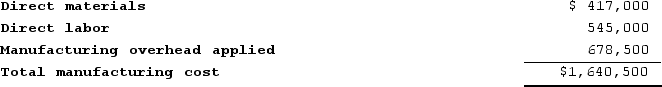

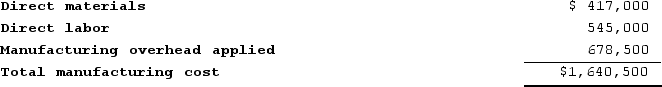

e. The total manufacturing cost added to work in process is:

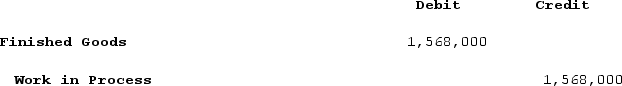

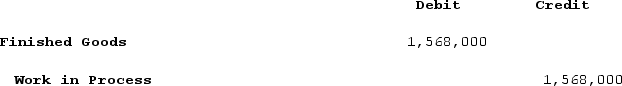

f. The journal entry to record the transfer of completed goods from Work in Process to Finished Goods is:<br>

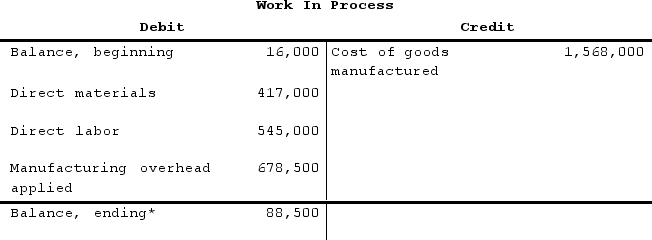

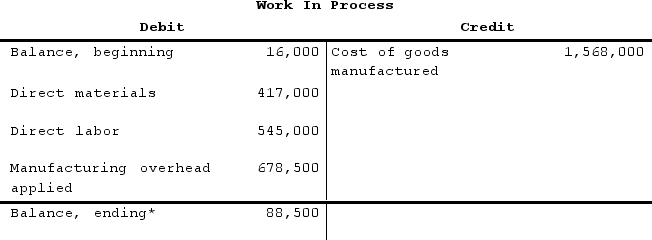

g. The ending balance in Work in Process is computed as follows:

*16,000 + (417,000 + 545,000 + 678,500) − 1,568,000 = 16,000 + (1,640,500) − 1,568,000 = 88,500

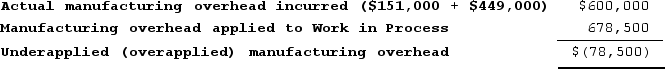

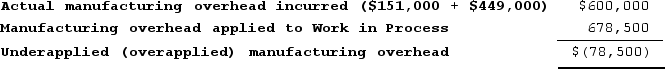

h. The overapplied or underapplied overhead is computed as follows:

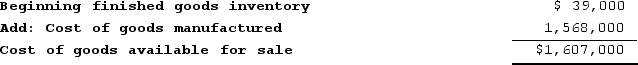

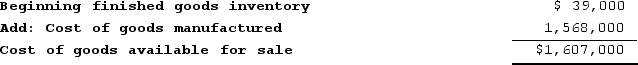

i. The cost of goods available for sale is computed as follows:

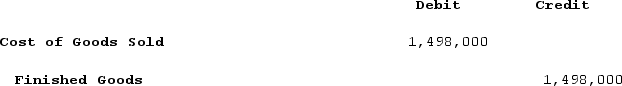

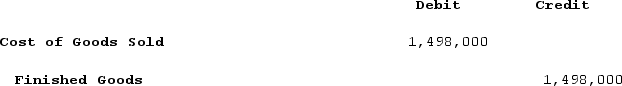

j. The journal entry to record the unadjusted Cost of Goods Sold is:

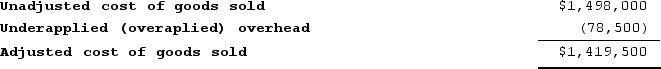

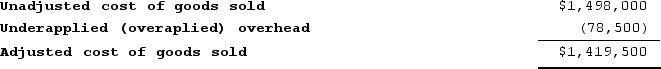

k. The adjusted Cost of Goods Sold for the year is computed as follows:

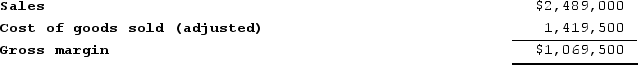

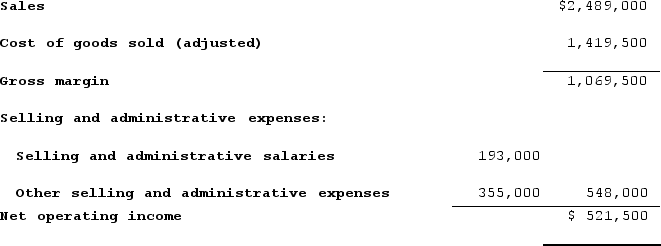

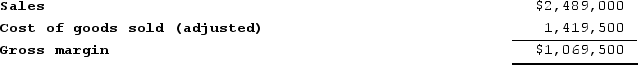

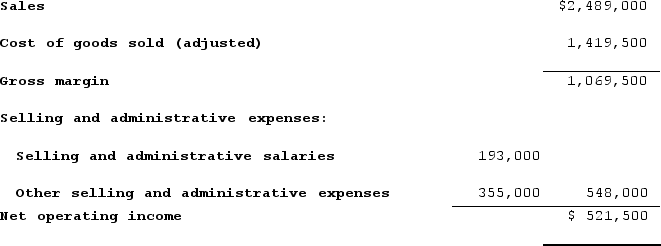

l. The gross margin is:

m. The net operating income is:

b. The ending balance in Raw Materials is computed as follows:

*38,000 + 453,000 − 417,000 = 74,000

c. The journal entry to record the direct and indirect labor costs is:

d. The total manufacturing overhead applied to production is computed as follows:

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base

= $708,000 ÷ 48,000 direct labor-hours = $14.75 per direct labor-hour

Overhead applied = Predetermined overhead rate × Amount of the allocation base incurred

= $14.75 per direct labor-hour × 46,000 direct labor-hours = $678,500

e. The total manufacturing cost added to work in process is:

f. The journal entry to record the transfer of completed goods from Work in Process to Finished Goods is:<br>

g. The ending balance in Work in Process is computed as follows:

*16,000 + (417,000 + 545,000 + 678,500) − 1,568,000 = 16,000 + (1,640,500) − 1,568,000 = 88,500

h. The overapplied or underapplied overhead is computed as follows:

i. The cost of goods available for sale is computed as follows:

j. The journal entry to record the unadjusted Cost of Goods Sold is:

k. The adjusted Cost of Goods Sold for the year is computed as follows:

l. The gross margin is:

m. The net operating income is:

Learning Objectives

- Learn about the system for recording the obtaining and application of raw materials in production settings.

- Compute the cost of direct materials utilizing the given data.

- Discern and allocate manufacturing overhead that is either under or over applied.

Related questions

Janeway Corporation Uses a Job-Order Costing System and Has Provided ...

During December, Moulding Corporation Incurred $87,000 of Actual Manufacturing Overhead ...

Dacosta Corporation Had Only One Job in Process on May ...

Information for the Deuce Manufacturing Company Follows ...

Piekos Corporation Incurred $90,000 of Actual Manufacturing Overhead Costs During ...