Asked by Hunain Nadeem on May 09, 2024

Verified

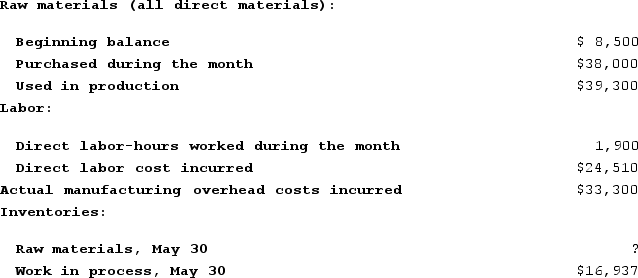

Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour. During May, the following activity was recorded:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

A) credit of $5,336 to Manufacturing Overhead.

B) credit of $1,660 to Manufacturing Overhead.

C) debit of $5,336 to Manufacturing Overhead.

D) debit of $1,660 to Manufacturing Overhead.

Underapplied Manufacturing Overhead

A scenario in which the designated costs for manufacturing overhead are below the overhead expenses that have been actually incurred.

- Determine the presence of underapplied or overapplied manufacturing overhead costs.

Verified Answer

SC

Sabrina ChavezMay 12, 2024

Final Answer :

D

Explanation :

The predetermined overhead rate is calculated by dividing the estimated total manufacturing overhead cost by the estimated total amount of the allocation base (direct labor hours in this case).

Predetermined overhead rate = $18.4 per direct labor-hour

Direct labor cost incurred during May = $3,741

Therefore, the estimated direct labor-hours incurred during May = $3,741 / $6,966 = 0.537 hours

Total overhead cost incurred during May = Actual direct labor-hours incurred during May x Predetermined overhead rate

Total overhead cost incurred during May = 0.537 hours x $18.4 per direct labor-hour = $9.90

The total manufacturing overhead cost for the job = $9,936

The total manufacturing overhead cost allocated to the job based on actual direct labor-hours incurred = 0.537 hours x $18.4 per direct labor-hour = $9.90

Therefore, the underapplied manufacturing overhead cost = $9,936 - $9.90 = $9,926.10

Since the manufacturing overhead cost allocated to the job based on actual direct labor-hours incurred is less than the total manufacturing overhead cost, there is an underapplied manufacturing overhead cost.

To dispose of the underapplied manufacturing overhead cost, we need to debit Manufacturing Overhead and credit Cost of Goods Sold.

The amount to be debited to Manufacturing Overhead is the amount of underapplied overhead cost, which is $9,926.10.

However, we also need to record the actual manufacturing overhead cost incurred during May, which is $9.90.

Therefore, the entry would be:

Debit Manufacturing Overhead $9,926.10

Credit Cost of Goods Sold $9,926.10

And in addition:

Debit Manufacturing Overhead $9.90

Credit Various accounts $9.90

Simplifying the above entry, we get:

Debit Manufacturing Overhead $1,660.00 (i.e. $9,926.10 - $9.90)

Credit Cost of Goods Sold $9,926.10

Hence, the answer is D) debit of $1,660 to Manufacturing Overhead.

Predetermined overhead rate = $18.4 per direct labor-hour

Direct labor cost incurred during May = $3,741

Therefore, the estimated direct labor-hours incurred during May = $3,741 / $6,966 = 0.537 hours

Total overhead cost incurred during May = Actual direct labor-hours incurred during May x Predetermined overhead rate

Total overhead cost incurred during May = 0.537 hours x $18.4 per direct labor-hour = $9.90

The total manufacturing overhead cost for the job = $9,936

The total manufacturing overhead cost allocated to the job based on actual direct labor-hours incurred = 0.537 hours x $18.4 per direct labor-hour = $9.90

Therefore, the underapplied manufacturing overhead cost = $9,936 - $9.90 = $9,926.10

Since the manufacturing overhead cost allocated to the job based on actual direct labor-hours incurred is less than the total manufacturing overhead cost, there is an underapplied manufacturing overhead cost.

To dispose of the underapplied manufacturing overhead cost, we need to debit Manufacturing Overhead and credit Cost of Goods Sold.

The amount to be debited to Manufacturing Overhead is the amount of underapplied overhead cost, which is $9,926.10.

However, we also need to record the actual manufacturing overhead cost incurred during May, which is $9.90.

Therefore, the entry would be:

Debit Manufacturing Overhead $9,926.10

Credit Cost of Goods Sold $9,926.10

And in addition:

Debit Manufacturing Overhead $9.90

Credit Various accounts $9.90

Simplifying the above entry, we get:

Debit Manufacturing Overhead $1,660.00 (i.e. $9,926.10 - $9.90)

Credit Cost of Goods Sold $9,926.10

Hence, the answer is D) debit of $1,660 to Manufacturing Overhead.

Learning Objectives

- Determine the presence of underapplied or overapplied manufacturing overhead costs.

Related questions

The Total Manufacturing Overhead Is Underapplied or Overapplied by How ...

The Total Manufacturing Overhead Is Underapplied or Overapplied by How ...

If a Company Applies Overhead to Jobs on the Basis ...

During December, Moulding Corporation Incurred $87,000 of Actual Manufacturing Overhead ...

Kahanaoi Corporation Is a Manufacturer That Uses Job-Order Costing ...