Asked by Dharmesh Kharel on Jul 25, 2024

Verified

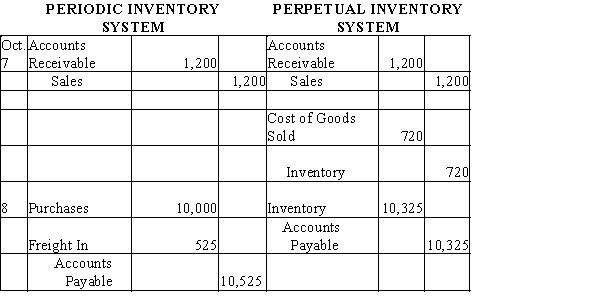

Journalize the following transactions for Armour Inc. using both the periodic inventory system and the perpetual inventory system, presented in the side-by-side format of the form provided below.Oct.7 Sold $1,200 of merchandise on credit to Rondo Distributors, terms n/30; the cost of the merchandise was $720.Oct. 8 Purchased merchandise, $10,000; terms FOB shipping point and 2/15, n/30; with prepaid freight charges of $525 added to the invoice.

Perpetual Inventory System

An inventory accounting system that records purchases and sales of merchandise immediately through the use of computerized point-of-sale systems and enterprise asset management software.

Periodic Inventory System

A periodic inventory system is an accounting method where inventory levels and cost of goods sold are determined at the end of an accounting period, not after each sale or purchase.

Freight Charges

Costs associated with transporting goods from one location to another, paid by the shipper or the receiver, depending on the terms of sale.

- Achieve proficiency in and use the perpetual inventory system for transaction logging.

Verified Answer

YM

Learning Objectives

- Achieve proficiency in and use the perpetual inventory system for transaction logging.