Asked by ethan battista on May 22, 2024

Verified

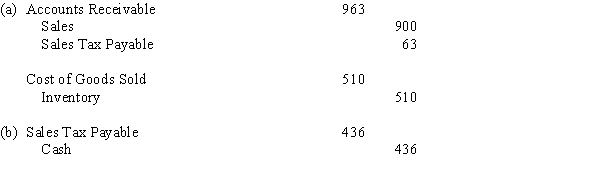

Journalize the entries to record the following selected transactions:

(a)Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.(b)Paid $436 to the state sales tax department for taxes collected.

Sales Tax

A tax on sales or receipts from sales, usually calculated as a percentage of the sale price and collected by the seller from the consumer at the point of sale.

Merchandise Sold

The total value of goods that have been sold by a company during a specific period, often reported on the income statement.

Sales Tax Department

The government department or agency responsible for collecting, administering, and enforcing sales tax regulations and payments.

- Attain knowledge of and deploy the perpetual inventory system for transaction notation.

Verified Answer

LS

Learning Objectives

- Attain knowledge of and deploy the perpetual inventory system for transaction notation.