Asked by Natalie James on Jun 12, 2024

Verified

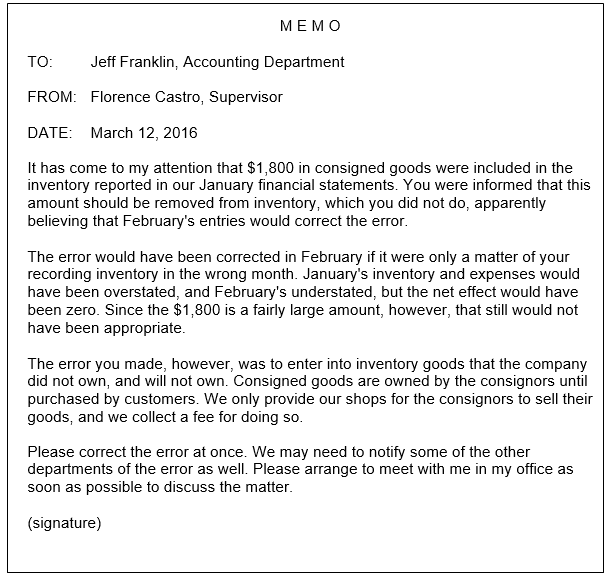

Jeff Franklin a new employee of Bail Company recorded $1800 in consigned goods received as part of the firm's inventory. The goods were received one day after the end of the fiscal period but Jeff reasoned that the goods should be included in inventory sooner because Bail paid the freight. The mistake was brought to his attention by the purchasing department who said the goods should not have been recorded as Bail inventory at all. Jeff told Jessie Sassoon the purchasing supervisor that nobody needed to worry because the mistake would cancel itself out the following month. In Jeff opinion there was no reason to get everyone excited over nothing especially since it was monthly and not annual financial statements that were affected. Jessie Sassoon has reported the problem to the accounting department.

Required:

You are Jeff's supervisor. Write a memo to Jeff explaining why the error should have been corrected.

Consigned Goods

Goods that are given to a third party to sell, but ownership remains with the supplier until sold.

Fiscal Period

A specific time frame used for accounting purposes, typically a year, over which a company reports its financial performance.

Freight

The charge paid for the transport of goods, usually based on the distance and weight of the merchandise being shipped.

- Explain the consequences of incorrectly recording inventory on financial statements.

Verified Answer

Learning Objectives

- Explain the consequences of incorrectly recording inventory on financial statements.

Related questions

Glenda Good and Danny Rock Are Department Managers in the ...

Hull Company Reported the Following Income Statement Information for the ...

If a Company Mistakenly Counts More Items During a Physical ...

Merchandise Inventory at the End of the Year Is Overstated ...

Merchandise Inventory at the End of the Year Was Inadvertently ...