Asked by Christopher Robin on May 09, 2024

Verified

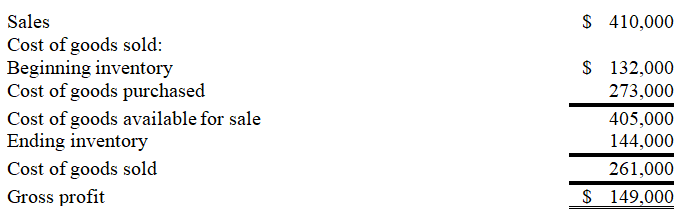

Hull Company reported the following income statement information for the current year:  The beginning inventory balance is correct.However,the ending inventory figure was overstated by $20,000.Given this information,the correct gross profit would be:

The beginning inventory balance is correct.However,the ending inventory figure was overstated by $20,000.Given this information,the correct gross profit would be:

A) $149,000.

B) $169,000.

C) $129,000.

D) $142,000.

E) $112,000.

Gross Profit

The difference between sales revenue and the cost of goods sold before deducting overheads, interest, tax, and other expenses.

Ending Inventory

The total value of all inventory still available for sale at the end of an accounting period.

Income Statement

An Income Statement is a financial statement that shows a company's revenues and expenses over a specified period, culminating in net profit or loss.

- Determine the effects of errors in inventory recording on financial statements.

Verified Answer

Learning Objectives

- Determine the effects of errors in inventory recording on financial statements.

Related questions

Overstating Ending Inventory Will Overstate All of the Following Except ...

During the Taking of Its Physical Inventory on December 31 ...

Penny Company Made an Inventory Count on December 31 2016 \(\begin{array}{lll}& ...

When Ending Inventory Is Understated ...

The Ending Inventory for This Year Is Overstated ...