Asked by Iliana Napoles on May 28, 2024

Verified

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A) 3.9%

B) 24.0%

C) 14.5%

D) 18.5%

Investment Opportunity

A potential venture or asset that presents the possibility for financial growth or returns.

ROI

Return on Investment, a financial ratio indicating the profitability of an investment relative to its cost.

Combined ROI

A metric that calculates the total return on investment from multiple investments or business units combined.

- Acquire knowledge on how to compute and the value of Return on Investment (ROI).

- Interpret the implications of investment opportunities on ROI and residual income.

Verified Answer

AE

Alexia EdwardsMay 29, 2024

Final Answer :

D

Explanation :

To calculate the combined ROI, we need to calculate the ROI for each division and then add them up.

For Division A:

ROI = (Net Income/Total Investment) x 100%

Without the investment opportunity, Net Income = $500,000 and Total Investment = $5,000,000

ROI = (500,000/5,000,000) x 100% = 10%

With the investment opportunity, Net Income = $600,000 and Total Investment = $6,000,000

ROI = (600,000/6,000,000) x 100% = 10%

For Division B:

ROI = (Net Income/Total Investment) x 100%

Without the investment opportunity, Net Income = $200,000 and Total Investment = $2,000,000

ROI = (200,000/2,000,000) x 100% = 10%

With the investment opportunity, Net Income = $240,000 and Total Investment = $2,800,000

ROI = (240,000/2,800,000) x 100% = 8.57%

Combined ROI = ROI for Division A + ROI for Division B

Without the investment opportunity:

Combined ROI = 10% + 10% = 20%

With the investment opportunity:

Combined ROI = 10% + 8.57% = 18.57%

Therefore, the combined ROI for the entire company will be closest to 18.5%, which is answer choice D.

For Division A:

ROI = (Net Income/Total Investment) x 100%

Without the investment opportunity, Net Income = $500,000 and Total Investment = $5,000,000

ROI = (500,000/5,000,000) x 100% = 10%

With the investment opportunity, Net Income = $600,000 and Total Investment = $6,000,000

ROI = (600,000/6,000,000) x 100% = 10%

For Division B:

ROI = (Net Income/Total Investment) x 100%

Without the investment opportunity, Net Income = $200,000 and Total Investment = $2,000,000

ROI = (200,000/2,000,000) x 100% = 10%

With the investment opportunity, Net Income = $240,000 and Total Investment = $2,800,000

ROI = (240,000/2,800,000) x 100% = 8.57%

Combined ROI = ROI for Division A + ROI for Division B

Without the investment opportunity:

Combined ROI = 10% + 10% = 20%

With the investment opportunity:

Combined ROI = 10% + 8.57% = 18.57%

Therefore, the combined ROI for the entire company will be closest to 18.5%, which is answer choice D.

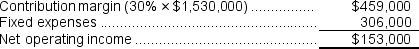

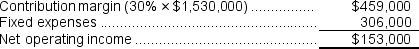

Explanation :  Net operating income = $567,000 + $153,000 = $720,000

Net operating income = $567,000 + $153,000 = $720,000

Average operating assets = $3,000,000 + $900,000 = $3,900,000

ROI = Net operating income ÷ Average operating assets = $720,000 ÷ $3,900,000 = 18.5%

Net operating income = $567,000 + $153,000 = $720,000

Net operating income = $567,000 + $153,000 = $720,000Average operating assets = $3,000,000 + $900,000 = $3,900,000

ROI = Net operating income ÷ Average operating assets = $720,000 ÷ $3,900,000 = 18.5%

Learning Objectives

- Acquire knowledge on how to compute and the value of Return on Investment (ROI).

- Interpret the implications of investment opportunities on ROI and residual income.

Related questions

The ROI for This Year's Investment Opportunity Considered Alone Is ...

The Division's Return on Investment (ROI)is Closest To

For the Past Year, the Return on Investment Was

The Division's Return on Investment (ROI)is Closest To

If the Company Pursues the Investment Opportunity, This Year's Combined ...