Asked by Samira Saghafi on May 12, 2024

Verified

If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

A) $776,100

B) ($60,000)

C) $720,000

D) ($17,100)

Residual Income

The amount of income that an individual or company has after all personal debts and expenses have been paid.

Investment Opportunity

A financial asset or venture that is expected to yield returns or profits in the future.

Combined Residual Income

The total residual income from all sources or divisions within an organization, after accounting for opportunity costs.

- Absorb the fundamental concept of residual income and its calculation methodology.

- Analyze the impact of investment opportunities on Return on Investment (ROI) and residual income.

Verified Answer

DG

Deivanai GanesanMay 13, 2024

Final Answer :

B

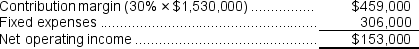

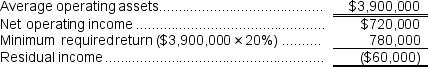

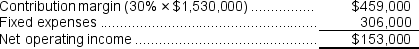

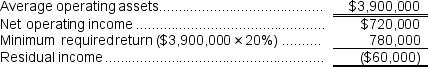

Explanation :  Net operating income = $567,000 + $153,000 = $720,000

Net operating income = $567,000 + $153,000 = $720,000

Average operating assets = $3,000,000 + $900,000 = $3,900,000 Reference: CH10-Ref13

Reference: CH10-Ref13

Edith Carolina is president of the Deed Corporation.The company is decentralized, and leaves investment decisions up to the discretion of the division managers.Michael Sanders, manager of the Cosmetics Division, has had a return on investment of 14% for his division for the past three years and expects the division to have the same return in the coming year.Sanders has the opportunity to invest in a new line of cosmetics which is expected to have a return on investment of 12%.The company's minimum required rate of return is 8%.

Net operating income = $567,000 + $153,000 = $720,000

Net operating income = $567,000 + $153,000 = $720,000Average operating assets = $3,000,000 + $900,000 = $3,900,000

Reference: CH10-Ref13

Reference: CH10-Ref13Edith Carolina is president of the Deed Corporation.The company is decentralized, and leaves investment decisions up to the discretion of the division managers.Michael Sanders, manager of the Cosmetics Division, has had a return on investment of 14% for his division for the past three years and expects the division to have the same return in the coming year.Sanders has the opportunity to invest in a new line of cosmetics which is expected to have a return on investment of 12%.The company's minimum required rate of return is 8%.

Learning Objectives

- Absorb the fundamental concept of residual income and its calculation methodology.

- Analyze the impact of investment opportunities on Return on Investment (ROI) and residual income.