Asked by Jordan Ratliff on Apr 29, 2024

Verified

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A) 14.4%

B) 2.7%

C) 11.7%

D) 18.8%

Combined ROI

A metric that aggregates the return on investment from multiple projects or business units into a single figure.

Investment Opportunity

A situation where funds can be placed in a venture with the expectation of earning a return on the investment.

- Gain insight into the impact of novel investment opportunities on established financial metrics.

Verified Answer

ZK

Zybrea Knight

May 04, 2024

Final Answer :

A

Explanation :

To calculate the combined ROI for the entire company, we need to use the formula:

Combined ROI = (Total Net Income / Total Investment) x 100

Last year, the company had a net income of $1,080,000 and an investment of $9,000,000, so the ROI was:

ROI = (1,080,000 / 9,000,000) x 100 = 12%

If the company pursues the investment opportunity, they will have an additional net income of $360,000 and an additional investment of $2,500,000. So, the total net income and total investment will be:

Total Net Income = 1,080,000 + 360,000 = 1,440,000

Total Investment = 9,000,000 + 2,500,000 = 11,500,000

Using the formula, the combined ROI will be:

Combined ROI = (1,440,000 / 11,500,000) x 100 = 12.52%

Therefore, the closest answer is A) 14.4%.

Combined ROI = (Total Net Income / Total Investment) x 100

Last year, the company had a net income of $1,080,000 and an investment of $9,000,000, so the ROI was:

ROI = (1,080,000 / 9,000,000) x 100 = 12%

If the company pursues the investment opportunity, they will have an additional net income of $360,000 and an additional investment of $2,500,000. So, the total net income and total investment will be:

Total Net Income = 1,080,000 + 360,000 = 1,440,000

Total Investment = 9,000,000 + 2,500,000 = 11,500,000

Using the formula, the combined ROI will be:

Combined ROI = (1,440,000 / 11,500,000) x 100 = 12.52%

Therefore, the closest answer is A) 14.4%.

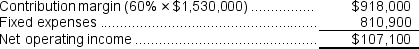

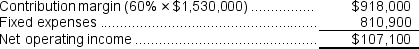

Explanation :  Net operating income = $456,000 + $107,100 = $563,100

Net operating income = $456,000 + $107,100 = $563,100

Average operating assets = $3,000,000 + $900,000 = $3,900,000

ROI = Net operating income ÷ Average operating assets = $563,100 ÷ $3,900,000 = 14.4%

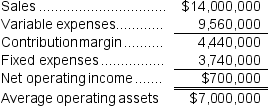

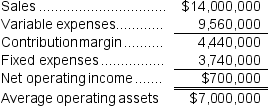

Reference: CH10-Ref5

Weafer Inc.reported the following results from last year's operations:

Net operating income = $456,000 + $107,100 = $563,100

Net operating income = $456,000 + $107,100 = $563,100Average operating assets = $3,000,000 + $900,000 = $3,900,000

ROI = Net operating income ÷ Average operating assets = $563,100 ÷ $3,900,000 = 14.4%

Reference: CH10-Ref5

Weafer Inc.reported the following results from last year's operations:

Learning Objectives

- Gain insight into the impact of novel investment opportunities on established financial metrics.

Related questions

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

An Investment Center Manager Is Considering Three Possible Investments ...