Asked by ?ông Ngô Trinh on Jun 24, 2024

Verified

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A) 12.0%

B) 8.6%

C) 10.4%

D) 1.7%

Combined ROI

A metric that aggregates the return on investment (ROI) from multiple projects or investments to assess overall performance.

Investment Opportunity

A potential investment that could yield financial returns, often evaluated for its risk-reward profile.

Company

An organized entity formed to conduct business activities, selling goods or services in exchange for profit.

- Apprehend the influence of emerging investment opportunities on existing financial indicators.

Verified Answer

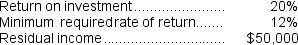

ROI for last year = ($4,000,000 - $3,200,000) / $3,200,000 = 25%

ROI for the investment opportunity = ($240,000 - $200,000) / $200,000 = 20%

Weighted average ROI = [(25% x $3,200,000) + (20% x $200,000)] / ($3,200,000 + $200,000) = 10.4%

Therefore, the closest combined ROI for the entire company is 10.4%, which is option C.

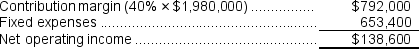

Net operating income = $700,000 + $138,600 = $838,600

Net operating income = $700,000 + $138,600 = $838,600Average operating assets = $7,000,000 + $1,100,000 = $8,100,000

ROI = Net operating income ÷ Average operating assets = $838,600 ÷ $8,100,000 = 10.4%

Reference: CH10-Ref10

The Tipton Division of Dudley Company reported the following data last year:

Learning Objectives

- Apprehend the influence of emerging investment opportunities on existing financial indicators.

Related questions

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

If the Company Pursues the Investment Opportunity and Otherwise Performs ...

An Investment Center Manager Is Considering Three Possible Investments ...