Asked by Angel Martinez on Jul 24, 2024

Verified

If Elly industries is able to obtain part MR24 from an outside supplier at a purchase price of $10 per unit, the monthly financial advantage (disadvantage) of buying the part rather than making it would be:

A) $30,000

B) $180,000

C) $90,000

D) $120,000

Monthly Financial Advantage

This term does not correspond to a widely recognized financial concept. However, it could refer to the monthly surplus or savings that a business or individual achieves after covering all their expenses.

Outside Supplier

A third-party entity or company that provides goods or services to another company, typically not affiliated with the purchasing company's internal structure.

- Comprehend the idea behind make-or-buy decisions and their influence on financial results.

Verified Answer

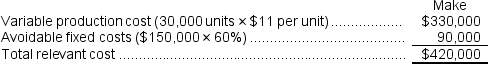

The cost to buy the part would be 30,000 units × $10 per unit = $300,000.The company would save $120,000.

The cost to buy the part would be 30,000 units × $10 per unit = $300,000.The company would save $120,000.Reference: CH11-Ref12

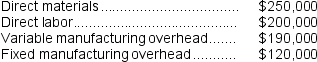

Melbourne Corporation has traditionally made a subcomponent of its major product.Annual production of 30,000 subcomponents results in the following costs:

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit.Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier.There would be no effect of this decision on the total fixed manufacturing overhead of the company.Assume that direct labor is a variable cost.

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit.Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier.There would be no effect of this decision on the total fixed manufacturing overhead of the company.Assume that direct labor is a variable cost.

Learning Objectives

- Comprehend the idea behind make-or-buy decisions and their influence on financial results.

Related questions

In Addition to the Facts Given Above, Assume That the ...

What Is the Financial Advantage (Disadvantage)of Purchasing the Part Rather ...

At What Price Per Unit Charged by the Outside Supplier ...

If Elly Industries Continues to Use 30,000 Units of Part ...

If Melbourne Decides to Purchase the Subcomponent from the Outside ...