Asked by Peter Bourgeois on Jul 12, 2024

Verified

At what price per unit charged by the outside supplier would Melbourne be indifferent between making or buying the subcomponent?

A) $29 per unit

B) $25 per unit

C) $21 per unit

D) $24 per unit

Outside Supplier

An external entity that provides goods or services to another company.

Indifferent

A state or condition where a decision-maker has no preference between two or more alternatives.

Subcomponent

A subcomponent is a constituent part that plays a role within a larger component or system, often essential for its functionality.

- Familiarize oneself with the concept of make-or-buy decisions and their consequences on financial health.

Verified Answer

SD

Shelbie DunlapJul 13, 2024

Final Answer :

D

Explanation :

Melbourne's current cost of producing the subcomponent is $21 per unit. However, they incur an additional $3 per unit in logistics and administrative costs. Therefore, their total cost of producing the subcomponent is $24 per unit.

To determine when Melbourne would be indifferent between making or buying the subcomponent, we need to find the price per unit charged by the outside supplier that is equal to Melbourne's total cost per unit ($24).

Option A - If the outside supplier charges $29 per unit, Melbourne's cost will be $32 per unit ($29 for the unit + $3 logistics and administrative costs). This is higher than their total cost of producing the subcomponent, so it is not a good choice.

Option B - If the outside supplier charges $25 per unit, Melbourne's cost will be $28 per unit ($25 for the unit + $3 logistics and administrative costs). This is lower than their total cost of producing the subcomponent, so it is a good choice.

Option C - If the outside supplier charges $21 per unit, Melbourne's cost will be $24 per unit ($21 for the unit + $3 logistics and administrative costs). This is equal to their total cost of producing the subcomponent, so Melbourne would be indifferent between making or buying the subcomponent.

Option D - If the outside supplier charges $24 per unit, Melbourne's cost will be $27 per unit ($24 for the unit + $3 logistics and administrative costs). This is equal to their total cost of producing the subcomponent, so Melbourne would be indifferent between making or buying the subcomponent.

However, since option D gives them the opportunity to focus their resources on other aspects of the production process (as they no longer have to worry about producing the subcomponent), it is a better choice than option C. Therefore, the best choice is option D ($24 per unit).

To determine when Melbourne would be indifferent between making or buying the subcomponent, we need to find the price per unit charged by the outside supplier that is equal to Melbourne's total cost per unit ($24).

Option A - If the outside supplier charges $29 per unit, Melbourne's cost will be $32 per unit ($29 for the unit + $3 logistics and administrative costs). This is higher than their total cost of producing the subcomponent, so it is not a good choice.

Option B - If the outside supplier charges $25 per unit, Melbourne's cost will be $28 per unit ($25 for the unit + $3 logistics and administrative costs). This is lower than their total cost of producing the subcomponent, so it is a good choice.

Option C - If the outside supplier charges $21 per unit, Melbourne's cost will be $24 per unit ($21 for the unit + $3 logistics and administrative costs). This is equal to their total cost of producing the subcomponent, so Melbourne would be indifferent between making or buying the subcomponent.

Option D - If the outside supplier charges $24 per unit, Melbourne's cost will be $27 per unit ($24 for the unit + $3 logistics and administrative costs). This is equal to their total cost of producing the subcomponent, so Melbourne would be indifferent between making or buying the subcomponent.

However, since option D gives them the opportunity to focus their resources on other aspects of the production process (as they no longer have to worry about producing the subcomponent), it is a better choice than option C. Therefore, the best choice is option D ($24 per unit).

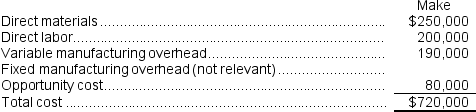

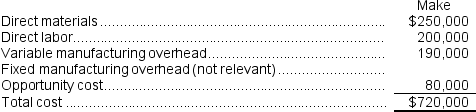

Explanation :  It costs the company $720,000 ÷ 30,000 units = $24 per unit to make the subcomponents.Therefore, the company would be indifferent between making the part or buying it at that price.

It costs the company $720,000 ÷ 30,000 units = $24 per unit to make the subcomponents.Therefore, the company would be indifferent between making the part or buying it at that price.

Reference: CH11-Ref13

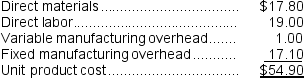

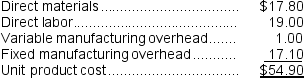

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows: An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

It costs the company $720,000 ÷ 30,000 units = $24 per unit to make the subcomponents.Therefore, the company would be indifferent between making the part or buying it at that price.

It costs the company $720,000 ÷ 30,000 units = $24 per unit to make the subcomponents.Therefore, the company would be indifferent between making the part or buying it at that price.Reference: CH11-Ref13

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $273,000 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

Learning Objectives

- Familiarize oneself with the concept of make-or-buy decisions and their consequences on financial health.

Related questions

In Addition to the Facts Given Above, Assume That the ...

What Is the Financial Advantage (Disadvantage)of Purchasing the Part Rather ...

If Elly Industries Continues to Use 30,000 Units of Part ...

If Melbourne Decides to Purchase the Subcomponent from the Outside ...

If Management Decides to Buy Part U98 from the Outside ...