Asked by Joshua Waterman on Jul 05, 2024

Verified

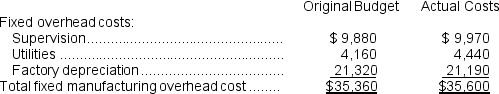

Hoag Corporation applies manufacturing overhead to products on the basis of standard machine-hours.Budgeted and actual fixed manufacturing overhead costs for the most recent month appear below:  The company based its original budget on 2,600 machine-hours.The company actually worked 2,280 machine-hours during the month.The standard hours allowed for the actual output of the month totaled 2,080 machine-hours.What was the overall fixed manufacturing overhead volume variance for the month?

The company based its original budget on 2,600 machine-hours.The company actually worked 2,280 machine-hours during the month.The standard hours allowed for the actual output of the month totaled 2,080 machine-hours.What was the overall fixed manufacturing overhead volume variance for the month?

A) $4,352 Favorable

B) $4,352 Unfavorable

C) $7,072 Unfavorable

D) $7,072 Favorable

Machine-Hours

The total hours that machines are in operation during the production process, used as a basis for allocating manufacturing overhead.

Fixed Manufacturing Overhead

Costs associated with manufacturing that do not vary with the level of production, such as rent and salaries.

Volume Variance

The difference between the budgeted and actual volume of production, affecting the budgeted levels of costs or revenues.

- Determine the variance in fixed and variable overhead, considering discrepancies related to budget and volume.

- Analyze the impact of actual activity levels against budgeted levels on manufacturing overhead

Verified Answer

Fixed component of predetermined overhead rate = Estimated total fixed manufacturing overhead cost ÷ Estimated total amount of the allocation base = $35,360 ÷ 2,600 machine-hours = $13.60 per machine-hour

= $35,360 - (2,080 machine-hours × $13.60 per machine-hour)

= $35,360 - $28,288

= $7,072 U

Learning Objectives

- Determine the variance in fixed and variable overhead, considering discrepancies related to budget and volume.

- Analyze the impact of actual activity levels against budgeted levels on manufacturing overhead

Related questions

At the Beginning of Last Year, Monze Corporation Budgeted $600,000 ...

Goolden Electronics Corporation Has a Standard Cost System in Which ...

Maertz Corporation Applies Manufacturing Overhead to Products on the Basis ...

Berk Incorporated Makes a Single Product--A Critical Part Used in ...

Edlow Incorporated Makes a Single Product--A Critical Part Used in ...