Asked by Kaylyn Masters on May 05, 2024

Verified

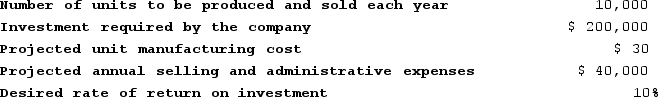

Hill Corporation is contemplating the introduction of a new product. The company has gathered the following information concerning the product:

The company uses the absorption costing approach to cost-plus pricing as described in the text.Required:a. Compute the markup on absorption cost.b. Compute the selling price.c. If the price computed in "b" above is charged, and costs turn out as projected, can the company be assured that no loss will be sustained on the new product? Explain.

The company uses the absorption costing approach to cost-plus pricing as described in the text.Required:a. Compute the markup on absorption cost.b. Compute the selling price.c. If the price computed in "b" above is charged, and costs turn out as projected, can the company be assured that no loss will be sustained on the new product? Explain.

Absorption Costing

This accounting style integrates all facets of manufacturing costs—direct materials, direct labor, and both variable and fixed overheads—into the comprehensive cost of a product.

Markup

The amount added to the cost of goods to cover overhead and profit, determining the selling price.

- Analyze the financial impact of accepting contracts or special pricing strategies on net operating income.

Verified Answer

HC

Hunter ClementsMay 12, 2024

Final Answer :

a.Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Unit sales]= [(10% × $200,000) + $40,000] ÷ [$30 × 10,000]= $60,000 ÷ $300,000 = 20%b.

![a.Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Unit sales]= [(10% × $200,000) + $40,000] ÷ [$30 × 10,000]= $60,000 ÷ $300,000 = 20%b. c.No, sales volume may be less than the 10,000 units projected annually, resulting in inadequate contribution margin to cover fixed costs, and a consequent loss for the company on the product.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62f8_f426_bf83_cfb65ce03ac4_TB8314_00.jpg) c.No, sales volume may be less than the 10,000 units projected annually, resulting in inadequate contribution margin to cover fixed costs, and a consequent loss for the company on the product.

c.No, sales volume may be less than the 10,000 units projected annually, resulting in inadequate contribution margin to cover fixed costs, and a consequent loss for the company on the product.

![a.Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Unit sales]= [(10% × $200,000) + $40,000] ÷ [$30 × 10,000]= $60,000 ÷ $300,000 = 20%b. c.No, sales volume may be less than the 10,000 units projected annually, resulting in inadequate contribution margin to cover fixed costs, and a consequent loss for the company on the product.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62f8_f426_bf83_cfb65ce03ac4_TB8314_00.jpg) c.No, sales volume may be less than the 10,000 units projected annually, resulting in inadequate contribution margin to cover fixed costs, and a consequent loss for the company on the product.

c.No, sales volume may be less than the 10,000 units projected annually, resulting in inadequate contribution margin to cover fixed costs, and a consequent loss for the company on the product.

Learning Objectives

- Analyze the financial impact of accepting contracts or special pricing strategies on net operating income.

Related questions

This Question Is to Be Considered Independently of All Other ...

This Question Is to Be Considered Independently of All Other ...

Jacoby Company Received an Offer from an Exporter for 30,000 ...

Stauffer Corporation Has Provided the Following Contribution Format Income Statement ...

Carver Corporation Produces a Product Which Sells for $40 ...