Asked by Kevin Oxrider on Jun 28, 2024

Verified

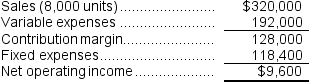

Stauffer Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.  The variable expense ratio is closest to:

The variable expense ratio is closest to:

A) 60%

B) 40%

C) 67%

D) 33%

Variable Expense Ratio

The ratio of variable costs to total sales, indicating how variable expenses change with sales levels.

Contribution Format

A way of presenting an income statement where variable costs are deducted from sales to show contribution margin before fixed costs are subtracted to show net operating income.

Income Statement

An income statement is a financial document that summarizes a company's revenues, expenses, and profits over a specific period, showing its financial performance.

- Explore the effects that adjustments in price and cost have on the contribution margin and net operating income.

- Assess the contribution margin per item and the related contribution margin percentage.

Verified Answer

Learning Objectives

- Explore the effects that adjustments in price and cost have on the contribution margin and net operating income.

- Assess the contribution margin per item and the related contribution margin percentage.

Related questions

Duve Corporation Has Provided the Following Contribution Format Income Statement ...

Kelchner Corporation Has Provided the Following Contribution Format Income Statement ...

Carver Corporation Produces a Product Which Sells for $40 ...

Thomason Corporation Has Provided the Following Contribution Format Income Statement ...

Boersma Sales, Incorporated a Merchandising Company, Reported Sales of 7,100 ...